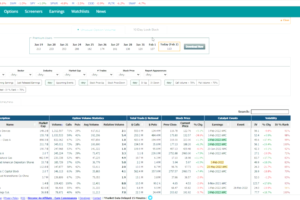

The market has been abuzz with the Elon Musk proposed acquisition of Twitter (TWTR). The company has agreed to be taken private by Musk at a price of $54.20 per share, but it could take several months to iron out the details. In the meantime, there has been a heavy amount of options trading on […]

Unusual Options

What’s Next For Twitter After Musk’s Buyout Offer

There’s never a shortage of drama when it comes to Elon Musk. The Tesla (TSLA) CEO recently announced an offer to buy Twitter (TWTR) for $54.20 a share (with the stock trading around $46 at the time). The social media site is extremely popular but has struggled to live up to financial expectations. On the […]

Trade of the Week: TWTR

Social media giant Twitter (TWTR) got a massive boost to the share price recently when the news came out that Elon Musk took a 9% stake in the company. He has since been named to the company’s board. Musk has a huge cult-like following, so many investors assume it will be bullish for the stock. […]

How The Russian Invasion Of Ukraine Affected The Options Market

While the headlines last week were rightfully focused on the humanitarian cost of the Russian invasion of Ukraine, under the surface, a lot was happening in the financial markets. Options action can give investors many clues as to what the market is most concerned with. On the day after the invasion began, there was a […]

Trade of the Week: Copper

When inflation is a going concern for the economy, we tend to see a lot of action in commodities and natural resource stocks. One heavily traded commodity stock last week was Freeport-McMoran (FCX), which is one the largest copper producers in the world. Options trading in FCX was unusually heavy on a day last week, […]

What’s Next For FB?

Last week, shares of Meta Platforms (FB) plunged after the company reported worse than expected earnings. In fact, the stock dropped over 26% in one day, the biggest single-day decline in its history. The company missed on revenues, revenue forecasts, and number of users. Despite the huge down day, about 61% of the 2 million […]

Trade of the Week: GOOGL

On a very busy week for earnings, Alphabet (GOOGL) shares got a huge boost after beating on both the top and bottom line. With the stock up 8% on the day after earnings, most of the options action was in calls. 71% of the options volume was on the call side, which tends to be […]

Trade of the Week: FCEL

While the markets were slow for the holiday season, it didn’t stop options in FuelCell Energy (FCEL) from trading quite briskly. The hydrogen fuel cell company released earnings last week and reported a wider than expected loss on lower revenues. The share price fell nearly 14% on the day with over 200,000 options trading. The […]

Trade of the Week: AA

Unusual options activity was not quite as brisk this past week with the short holiday week, but Alcoa (AA) did trade over twice the options volume over what it normally trades. The aluminum giant has climbed from $45 to $60 this month after a number of positive news items came out, including the stock being […]

One Way To Trade CSCO After It Missed Earnings

Networking giant Cisco Systems (CSCO) dropped 5% the day after earnings were released last week. The company’s’ guidance was disappointing to investors and revenues were lower than expected. However, one trader used this opportunity to enter a covered call trade. The trader purchased 1.35 million shares of CSCO (at $51.77) while selling 13,500 calls that […]