Last week’s earnings reports from a few different REITs indicated that commercial office space and commercial lending have not fallen into the crisis the financial media has warned of. The fear in the markets is that low office space occupancy will lead to declining property values and commercial mortgage defaults. Also, since commercial mortgages are […]

Dividend Investing

The Good News in Preferred Stocks

Last week I was a speaker at the MoneyShow in Las Vegas. Besides speaking, I like to network with a wide range of investment professionals. I was intrigued by one idea concerning preferred stocks from the discussions: that they will allow investors to benefit from the Fed’s interest rate increases. Preferred stock shares can be […]

The Dollar Is Going to Bounce and Here’s What that Does to Stocks

The Dollar Index (DXY) just hit a 1-year low almost to the day. Last April, we saw the DXY almost breaking below 101 as it is right now. It’s interesting… As the Dollar moves up and down… it’s almost perfectly correlated to how stocks move. When the Dollar dropped 10%+ this year, stocks have rallied […]

What’s The Story With Real Estate?

Options block trades can be interesting tools to gauge market expectations, even if you don’t know exactly what the purpose of the trade is. For instance, a big put spread traded last week in iShares US Real Estate ETF (IYR). The trade occurred on the same day that lower housing prices were reported across the […]

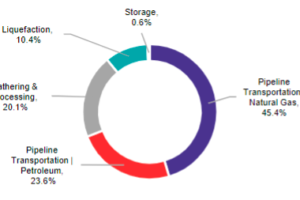

The Yin and Yang of Energy Midstream Stocks

In these uncertain times for investors, energy midstream stocks offer an island of stability. This sector provides an attractive combination of current yield and dividend growth. However, midstream companies divide into two distinct categories, and the differences are important. Energy midstream covers the movement and storage of energy commodities from the upstream drillers to the […]

Preferred Shares Discussion With Jay Hatfield of Infracap Advisors

Not long ago, I had the chance to sit down and chat with Jay Hatfield at InfraCap Advisors and talk about the current market environment. I try to get a chance to speak with Jay several times a year as his insights into markets and the economy always add value and help shape a profitable […]

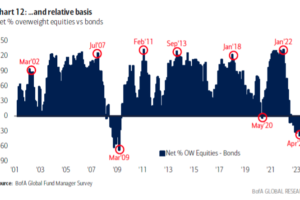

Even the Pros Get Market Timing Wrong

Even with professional investors, herd mentality makes successful investing a daunting task. This year, as you see prediction after prediction about a market decline, stocks have confounded the experts with solid gains. My Dividend Hunter strategy shows investors how to not fall into the “buy high, sell low” wealth destruction cycle. Last week, one of […]

Why small cap stocks is hinting where the market’s about to go

Most stocks are correlated to the indexes in some way. However, small cap stocks have been beaten down tremendously in the past couple years. Even with stocks rallying from October 2022 lows… small cap stocks aren’t finding relief. Today, I pulled up a chart showing the correlation between small cap stocks and the S&P 500. […]

Is Amazon Going To Beat Earnings?

Investors never know for sure if a company is going to post better earnings results than expected. That’s why there are always earnings surprises. However, that doesn’t keep traders from making educated guesses. In the case of Amazon (AMZN), a trader recently purchased 17,000 bullish call spreads that expire the day after earnings come out. […]

The Cure for a Directionless Market

High current yields and growing dividends are the cure for the directionless market. And if we are in for a “lost decade” from the stock market, yield plus growing dividends is one strategy that will still produce positive total returns. The strategy works in any market—bull, bear, or stagnant. Let me show you. Over the […]