Even with professional investors, herd mentality makes successful investing a daunting task. This year, as you see prediction after prediction about a market decline, stocks have confounded the experts with solid gains. My Dividend Hunter strategy shows investors how to not fall into the “buy high, sell low” wealth destruction cycle.

Last week, one of the morning emails from Bloomberg noted: “…stocks are doing well. 2023 continues to be a great year. The S&P 500 is already up over 8%, while the NASDAQ is already up over 16%. If you just stopped things here, 2023 is a winner.”

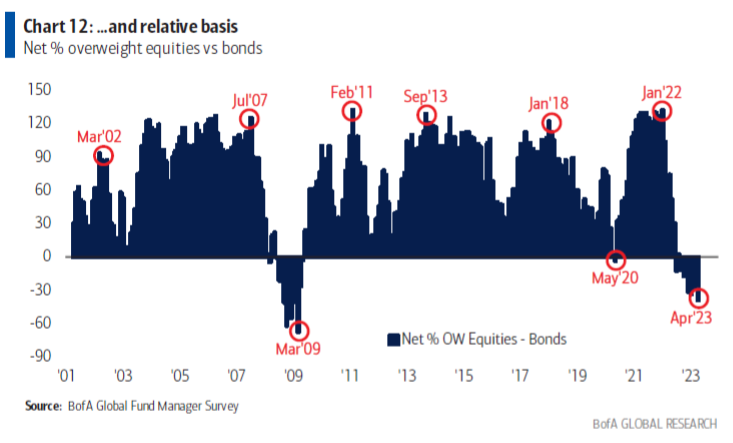

The following paragraph discusses how, despite the good results in the market, sentiment remains negative. The exact words were: “…rallies are always hated these days.” The most recent Bank of America fund manager survey shows that active fund managers are the most pessimistic they have been since March 2009. Here is the tell-tale chart:

The chart shows the relative weighting between stocks and bonds by the fund/asset managers surveyed by the Bank of America. The peaks show when the investment pros were most heavily weighted in stocks and the low points where they had the lowest percentage of assets in the stock market.

For me, a few of the highlighted dates pop off the chart. March 2009 marked the absolute bottom of the Great Financial Crisis bear market. The post-pandemic bull market started in late Spring 2020 and peaked during the very first days of 2022. Last year was a true bear market, and now that stocks have turned up, money manager stock allocations are at the lowest level since 2009.

Two points to take away from this: first, no one can predict market downturns and bull markets. Professional fund managers consistently get it wrong. Second, there is a huge herd mentality among financial professionals. They all read the same reports and look at the same data. Also, those folks who manage money tend to not be the ones who show up on the financial news making bold predictions.

I don’t know if we are on the verge of a new bull market. My opinion is that stocks will stay range bound as they have for almost the last year. I may be wrong. (I am probably wrong.) We now operate in an investing world where every little bit of news moves the market until the next news item comes along.

For my Dividend Hunter subscribers, I recommend and teach a strategy to invest in building a growing income stream using high-yield investments, stocks, and ETFs. The focus is not on share prices because they are not predictable.

However, when you want to build up your portfolio income, you naturally end up buying more when prices are down, and you will see your portfolio value grow nicely when the market turns bullish. All along the way, the Dividend Hunter strategy focuses on building a growing income stream, a goal entirely within your control.

Let’s close out with an investment idea. REITs have performed poorly (actually, terribly) for the last 15 months. I don’t know if real estate stocks have bottomed, but I know you can invest in the Hoya Capital High Dividend Yield ETF (RIET) and earn a 10% yield with monthly dividends until the investing world realizes that real estate will never go away.