Sonos (SONO) is a relatively new company that has only been trading on the major exchanges for a few years. In August 2018, the company priced its initial public offering at $15 a share, below the expected range of $17–$19. SONO made a splashy debut on the market, zooming 32% in its first day of […]

Dividend Yield Ratio: The Metric Every Investor Should Know

Keep reading to learn all about dividend yield ratio, including how to calculate it and how it can help you evaluate dividend stocks.

Three High-Yield Stocks Paying Extra Dividends

The pandemic-triggered shutdown of a large portion of the global economy forced many companies to cut dividend payments, or at least stop growing their dividend rates, for most of the last year and a half. Although we now seem to be in a reopening phase, I sense a reluctance from Boards of Directors to bring […]

Trade of the Week: MRNA

Two of the big COVID vaccine producers, Moderna (MRNA) and Pfizer (PFE), saw a significant amount of options activity last week. On one day, with MRNA down nearly 6%, its options traded 4x the normal volume. Most of the activity was still on the call side of things though, which tends to be a bullish […]

How to Maximize Your Returns with Oversold Options

Some of the best options trading opportunities can be found in wildly oversold stocks. Look at Activision Blizzard (ATVI), for example. ATVI gapped from a high of $91.40 to a low of $78 on fears of litigation and a potential Chinese crackdown on video games. To me, that pullback was overkill—especially at a time when […]

Option Premiums and Their Impact on Options Trading

An option premium is the money you earn for selling an option. Read on for a better understanding of premiums and what drives their pricing.

#1 Technical Trader Reveals Where Bitcoin Could Go Next

I’m still on vacation… but with the recent rally in cryptocurrencies, I’m digging into some charts on them. With Bitcoin, Ethereum and others, there are no “fundamentals” to study. Meaning, all we have is the chart to predict where we think these prices could go. Right now, they’re rallying strong… And going into the fall, […]

These Dividend Stocks Could Be More Profitable From Electric Cars Than Tesla Ever Will

The Biden administration recently indicated they want 50% of all vehicle sales by 2030 to be zero-emission—i.e., electric cars. While I am skeptical that Americans will be willing to buy that many electric vehicles, my thoughts today concern what companies will profit from the electrification of the U.S. vehicle fleet. And it’s worth noting that […]

The Top Three Options Trading Errors to Avoid

At some point, everyone makes mistakes when trading options—even the pros. However, as long as you’re aware of them, you’re less likely to repeat the same mistake over and over again, ad nauseum. Error No. 1: Not Having a plan One of the worst things any trader can do is trade without a plan. Without […]

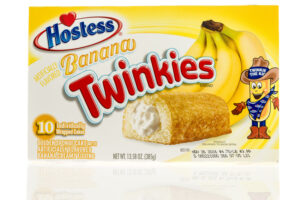

Hostess Brands (TWNK) Looks Like a Sweet Deal

Hostess Brands (TWNK) is an iconic brand that has been around for decades and is the reincarnation of the old Hostess Brands. Some of its best-selling products include: Twinkies, Ho-Hos, Hostess Cupcakes, Ding-Dongs, as well as breads and cookies. Which filed for bankruptcy in 2012. A couple of years ago, Hostess Brands bought Voortman Cookies, […]