The American Dream is simple: A fruitful career, owning your own home, and eventually reaping the fruits of your labor with a financially secure retirement.

Unfortunately, for most Americans, the ‘American Dream’ is turning into just that: A dream.

And it’s all thanks to what I call the $30 Trillion Retirement Scam”, you may be on a path for financial disappointment vs. the retirement of your dreams.

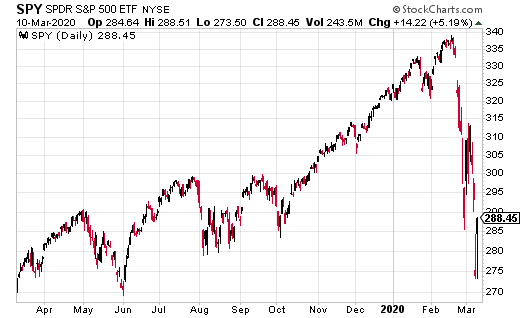

And the bond and stock market crash of recent days shows how fragile a plan dependent on those markets can be.

Make no mistake: Retirees have been swindled out of Trillions

The $30 Trillion Retirement Scam stems from the 40-year shift away to defined benefit pension plans, pushing employees into 401(k) plans, where your retirement savings are subject to market risks. Under a defined benefit plan, your employer promised to pay a set amount of retirement income after your working days.

Unfortunately, since the 401(k)-type plan became available employers have dumped their defined benefit plans. Money set aside for your retirement goes into stock and bond ETFs and mutual funds, where you shoulder the risk of whether you will have enough money to make it through a 30 to 40-year retirement.

The stress alone of worrying whether you have enough money to fund your retirement could shorten your days and definitely make your retirement years less enjoyable.

Let me recap:

- You can’t count on your employer to provide a dependable retirement income.

- With the interest rates on government bonds and CD’s at 1% or lower, you can’t count on the interest income from bonds or bond funds.

- Stock prices go down as well as up. Look at the current decline where individual stocks are down 10% to 50%. The SPDR S&P 500 ETF (SPY) covers the broad stock market and is down 18% in less than three weeks. You can count on share price appreciation to fund a safe, long-term retirement.

Years of experience led me to a different strategy for turning retirement savings into an attractive retirement income that will last for as long as you need the income.

All to answer one question…

Will Your Retirement Work for You?

With a diversified portfolio of dividend-paying stocks and funds, you can have a portfolio that pays a predictable cash income stream.

Even experienced investors are surprised to learn there are stocks with yields of 6%, 8%, or even into the double digits. Many of these high yield investments are companies that have paid dividends for years.

My high yield strategy focuses on building a diversified portfolio of these high yield investments. The portfolio provides a predictable income stream.

If you are not yet ready to retire, reinvest the dividends to compound the income stream. If you are prepared to retire or in retirement looking for more certainty in your future soon, take a portion of the dividends to be your retirement income and reinvest a part to continue to build the income stream and give yourself a raise every year.

For example, the average yield in my Dividend Hunter Newsletter recommendations list is over 8%. That means that if you are retired, draw 5% or 6% per year and have cash left over to invest for future growth. Compare that to the widely espoused financial advisor recommendation of selling stocks to draw 4% per year.

For far too many Americans, the ‘American Dream’ may be a mere fantasy but for you it doesn’t have to be.

You simply need to create for yourself what’s been taken from us: A lifetime’s worth of income as a reward for doing everything right.