U.S. natural gas pipeline giant ONEOK (OKE) is set to buy Magellan Midstream Partners (MMP), which owns a pipeline network that primarily transports crude oil and refined products for $18.8 billion. This is going to be huge for investors… Magellan shareholders will receive $25 cash and two-thirds of an ONEOK share for each unit of […]

Author: Tony Daltorio

Don’t Miss the Winner of America’s Hidden Stock Boom

The stock market seems focused on only two types of stocks: technology companies involved with AI, and regional banks—which are going through a crisis. Investors are ignoring the rest of the stock market, which is just drifting. But that should not stop you from picking out a few investing gems from the large body of […]

Forget Tech; Invest Here Instead

Once again, technology stocks are grabbing the financial headlines. They have powered most of the gains in the S&P 500 in 2023. In fact, Apple and Microsoft alone now account for a record 13.5% of the index—the most ever for the top two stocks. While it’s tempting to buy big tech right now, the safer […]

How to Play the Upcoming U.S. Manufacturing Boom

The U.S. seems poised for a manufacturing boom as companies tap into government subsidies, pledging to spend tens of billions of dollars on new projects. The Chips and Science Act and the Inflation Reduction Act (IRA)—passed within days of each other last August—together include more than $400 billion in tax credits, grants and loans designed […]

Pharma Giant On the Mend

The pharma giant GSK PLC (GSK) is working to emerge from years with a share price that goes nowhere. The company’s CEO, Emma Walmsley, is still trying to convince investors that she is delivering a “new chapter of growth” after many years of underperformance. GSK shares are down 3% over the past five years, while […]

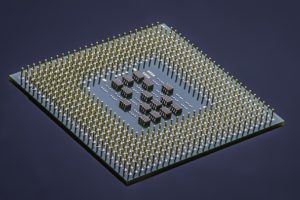

Add This Cheap Chip Play to Your Portfolio

The pandemic certainly turned the semiconductor industry on its head. Despite record production of semiconductors, shortages everywhere led to months-long waiting lists for many consumer products. To meet consumer demand, semiconductor makers ramped up supply even more. But then inflation arrived and decided to stay awhile. Central banks responded by raising rates, and economies slowed. […]

Buy This Pharma Powerhouse With a 4% Yield

Imagine a company whose stock that hit an all-time in December 2021, after soaring 50% that year. And that company’s sales doubled in the two years leading up to 2022. And its operating profits quadrupled. Also imagine a company whose biggest product is set to see its sales collapse in the next three years from […]

This Sports and Entertainment Tie-Up Is Going to Be a Winner

It may come as a surprise to some, but when sports and entertainment are joined together, it is very popular—and therefore a real moneymaker. That’s why the recent news of one of the biggest names in entertainment is moving to take over one of the biggest in sport entertainment piqued my interest. Let me show […]

The Rush for Copper Is On

The global transition away from fossil fuels in favor of low carbon energy sources is accelerating. In 2022, a little more than $1 trillion was invested in new technologies such as renewable energy, energy storage, carbon capture and storage, electric vehicles, and more. Not only is this a new annual record amount, but—for the first […]

Alibaba’s Bold New Survival Strategy

Major changes are underway at Alibaba (BABA), China’s best known e-commerce company, which was founded 24 years ago by Jack Ma. And this time, Ma is hoping for better results. The last time Alibaba made a big move to reorganize its business, the company set in motion a chain of events that led to a […]