The pandemic certainly turned the semiconductor industry on its head.

Despite record production of semiconductors, shortages everywhere led to months-long waiting lists for many consumer products. To meet consumer demand, semiconductor makers ramped up supply even more.

But then inflation arrived and decided to stay awhile. Central banks responded by raising rates, and economies slowed. The appetite for items like consumer electronics waned, leaving inventories stuffed full of chips.

The ramifications were felt all along the semiconductor supply chain.

For example, when Apple (AAPL) reduced orders of memory chips last year, supplier Micron Technology (MU) saw its sales collapse. To preserve cash flow, Micron chose to cut capital spending by 40% in 2023.

That, of course, means it will need less equipment from its supplier Lam Research (LRCX). Lam now expects the wafer front-end market—which relates to the first process in chip fabrication—to shrink around 30% in 2023, to $70 billion. As a natural consequence, Lam’s share price is down by a third since the start of 2022. That makes it an interesting stock to buy now. Let me explain.

Lam Research: Profitable and Cheap

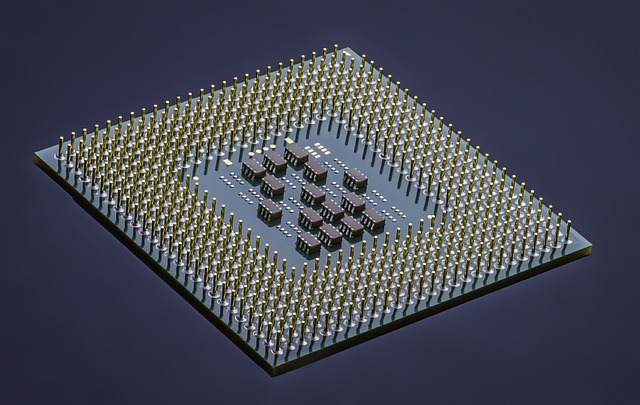

Lam Research sells the equipment used to make semiconductor wafers. This includes the deposition machines that deposit layers of metal, the etch machines that selectively remove some of those layers, and the cleaning machines that take away unwanted particles between stages. Aside from Micron, Lam’s customers include these other semiconductor titans: Samsung, SK Hynix, Intel (INTC), and Taiwan Semiconductor (TSM).

Historically, Lam has focused mostly on the memory market. Last year, 50% of its sales came from either NAND or DRAM memory chip manufacturers. Memory chips exposure to demand in consumer electronics makes demand for them highly cyclical.

Less than a fifth of LAM’s sales came from logic chips, where, thanks to cloud computing exposure, demand is more consistent and expected to grow quite rapidly amid rising artificial intelligence investments.

This cyclicality in Lam’s business largely explains why it trades at a steep discount to other chip equipment manufacturers. For example, ASML (ASML), which sells the photolithography machines needed to produce the most advanced logic chips, trades on a forward price to earnings ratio of 31, versus less than 15 for Lam’s shares.

In addition to the cyclicality of consumer electronics demand, the company is facing another problem.

Last year, the U.S. imposed strict sanctions against Chinese semiconductor manufacturers, barring companies from selling chip designs and manufacturing equipment to Chinese businesses. Lam predicted these restrictions would result in a $2 billion to $2.5 billion hit to sales. That led to Wall Street analysts cutting their 2023 earnings forecast by 13%.

Despite all of this, Lam’s leadership position in a consolidated sector allows it to be highly profitable. In recent years, its operating margin has exceeded 25%; it hit 31.1% in the year to June 2022. This enabled Lam to generate a five-year average return on equity of over 50%.

Lam also generates a good free cash flow yield of 5%, well ahead of ASML and equal to its close rival, Applied Materials (AMAT). In the last two years, the company spent $1.1 billion on capital expenditure, but still managed to generate $5.5 billion in free cash flow.

Lam’s Bright Future

Lam’s management is wisely using some of that capital expenditure to move away from its reliance on the memory chip market. Some of these investments include atomic layer deposition and selective etch technologies.

The company is already the market leader in dry etch, and a prominent player in the deposition segment of the wafer fab equipment industry. The combination of these two is critical during the chip making process, along with photolithography (which produces the mask that exposes areas for materials to be deposited or removed).

Lam provides customers with some of the most advanced tools in these niche segments. And its leadership position creates scale advantages that fuel its research and development spending at levels only Applied Materials and Tokyo Electron (TOELY) can match.

We cannot overlook the fact that there is a major tailwind blowing in Lam’s favor. This comes in the form of the U.S. government’s efforts to boost domestic chip manufacturing. Last year’s Chips and Science Act includes $39 billion in manufacturing incentives for chip makers. This has produced results, with commitments from Intel, Samsung, and TSM to invest over $100 billion between them in the U.S. over the coming years.

So, while Lam may lose much of its Chinese business, the increase in investment into the U.S. from these companies will likely make up for it.

Keep in mind, too, that other nations are not sitting by idly; in fact, some are also offering incentives to chip companies to build semiconductor manufacturing capacity. For instance, in South Korea, Samsung has been offered incentives to invest $230 billion in a new memory chip manufacturing facility over the next 20 years.

So, while the near-term outlook is murky, Lam’s future as a leading equipment manufacturer in a heavily-subsidized industry looks bright. Its relationships with all the top chip makers in the world, combined with historically strong levels of capex spending in the industry, leaves Lam Research with a quasi-monopolistic position in its niche.

That should help it to continue to generate strong profit margins and consistent cash flows. LRCX is a buy in the $480 to $520 range.