It’s never a bad idea to know how to minimize your equity exposure, especially right now, as the market is showing some cracks in its armor lately. The S&P 500 was down roughly 5% in September, the first down month in 2021 since January, and the largest since the pandemic hit in March 2020.

Granted, September tends to be a more volatile month than most—plus, quarter-end positioning can skew the numbers as well. Nevertheless, the third quarter ended on a down note. It can be a vital reminder that the markets don’t always behave.

Fortunately, there’s a straightforward solution to protecting your downside exposure: hedging with options.

The simplest way to hedge equity risk is to buy a put on an index, such as one that tracks the S&P 500. The problem with this strategy is it can get expensive in a hurry. Index puts tend to be in demand as hedges, so their prices can be inflated.

Using vertical spreads (i.e., put spreads) can help alleviate these costs. You can spend a lot less in premiums by selling a further-away put, against the put you purchased for protection. The drawback is the put spread will cap your gains—especially in a crash-like scenario—however, it’s usually a reasonable tradeoff. Crashes happen rarely, but hedges are often made monthly. The costs can add up in a hurry, so it makes sense to lower the cost and accept less return.

What’s more, instead of using broad-based indexes (which can have high stock prices and thus high option prices), hedges can be made at a more granular level. Using sector ETFs is one way to accomplish this.

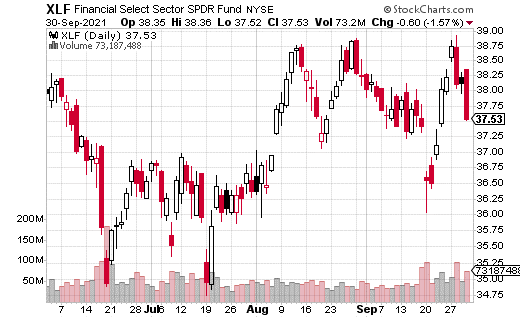

For example, I recently came across a put spread placed in Financial Sector Select SPDR Fund (XLF). XLF is the most popular exchange-traded fund (ETF) for tracking the financial sector. It includes banks, insurance companies, and asset management companies.

XLF is up 27% year-to-date and is close to the top of its 52-week range. A strategist may have decided that the sector is due for a pullback or simply wants to protect against that scenario. Moreover, the S&P 500 was down 5% in September, while XLF was only down a little over 2%. A hedge in XLF could make sense if someone expects XLF to “catch up” to the S&P 500.

The trade—a put spread, as I described above—expires in November and was purchased with XLF trading $37.64. Specifically, the November 37 puts were purchased while the 32 puts were sold.

The entire put spread cost $0.82 (5,500 of the spreads traded in one block), which is also the max loss on the trade if XLF doesn’t drop below $37 by expiration. If the 37 puts were purchased by themselves, the trade would cost $1.06 instead.

The position breaks even at $36.18 but can make money all the way down to $32. In that case, $4.18 in profits could be realized at expiration. That’s a 510% return on the hedge (or downside speculative bet). In other words, it’s a relatively efficient use of capital to protect downside exposure in the financial sector.