I have been known to call closed-end funds (CEFs) the “junkyard of Wall Street.” A few good funds exist, but they are hard to dig out of the 387 publicly traded CEFs.

One issue with closed-end funds is the widespread use of managed dividend policies.With a managed dividend policy, the fund managers set a dividend rate that they “hope” they can earn through interest, dividends, and capital gains. What you often see are CEFs that have portfolios of low-yield stocks and double-digit dividend yields. When the fund does not earn enough in dividends and capital gains, large portions of the dividends get paid to investors as a return of capital (ROC)—the bad kind of ROC. (There is a good ROC, but that is a discussion for another day.)

When I start looking at a high-yield CEF, I go right to the dividend breakout page to see how much ROC the fund is paying. Often, 50% or more of the dividends will have a destructive ROC.

One of my newsletter subscribers asked me to look into the Adams Diversified Equity Fund (ADX). I was pleasantly surprised by this CEF’s dividend policy.

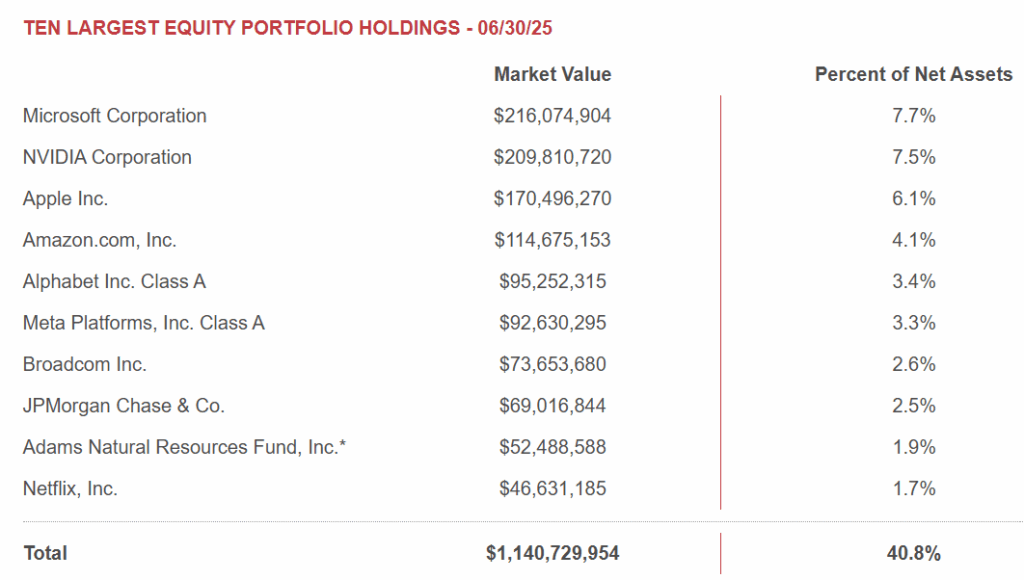

The ADX holdings look very similar to what you will see with dozens, if not hundreds, of CEFs and actively managed ETFs:

The fund is not leveraged and has an average distribution yield of 8.4%.

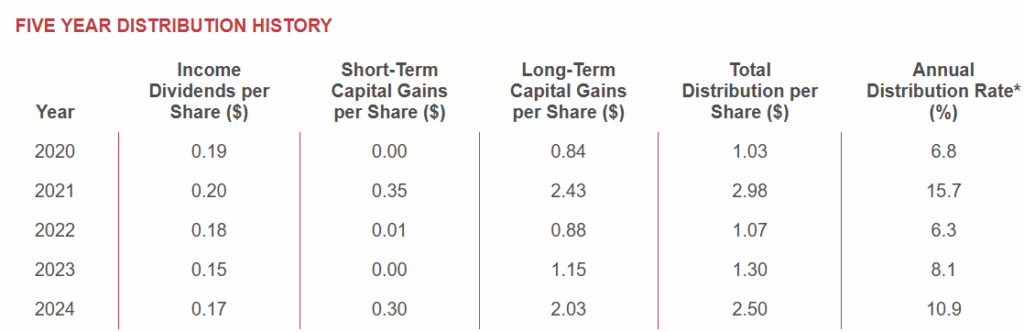

What caught my eye is that ADX does not have a managed distribution policy. It pays out to investors what it earns. Here are the distributions paid for the last five years.

You can see that the fund managers are paying out what they earn, and not pumping up the CEF’s yield with ROC payments. I am impressed with the honest approach.

That said, the returns from ADX do not stand out. An investor would not be disappointed with this fund, but I believe there are better ways to gain investment exposure to the large-cap stocks the fund owns.

Collect $4,670 in extra monthly income by Halloween

I’ve just released updated details on a new system for collecting steady dividend income each and every month. The next big chunk is coming up between now and Halloween at $4,670 in extra monthly income. The deadline is this coming Friday.

Click here for details and to start collecting extra income.