I like companies that generate large amounts of free cashflow. I get excited when shares of a high cashflow look very cheap in relation to the cash being produced by the business. In short, I like companies that make a lot of money. If you’re like me, consider refining stocks. Let me show you one […]

Author: Tim Plaehn

This Strategy Works Great Even in These Ugly Markets

For almost a year, the stock market has been brutal for those investors who have tried to time the next upturn or downturn. Since the bear market first bottomed last June (and then again in October), the stock market rallies have run enough to get investors excited before dashing their hopes by turning down again. […]

So Far, No Crisis

Last week’s earnings reports from a few different REITs indicated that commercial office space and commercial lending have not fallen into the crisis the financial media has warned of. The fear in the markets is that low office space occupancy will lead to declining property values and commercial mortgage defaults. Also, since commercial mortgages are […]

The Good News in Preferred Stocks

Last week I was a speaker at the MoneyShow in Las Vegas. Besides speaking, I like to network with a wide range of investment professionals. I was intrigued by one idea concerning preferred stocks from the discussions: that they will allow investors to benefit from the Fed’s interest rate increases. Preferred stock shares can be […]

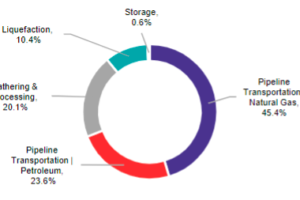

The Yin and Yang of Energy Midstream Stocks

In these uncertain times for investors, energy midstream stocks offer an island of stability. This sector provides an attractive combination of current yield and dividend growth. However, midstream companies divide into two distinct categories, and the differences are important. Energy midstream covers the movement and storage of energy commodities from the upstream drillers to the […]

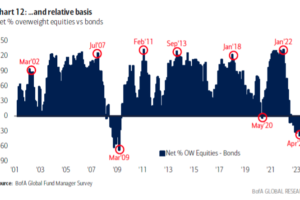

Even the Pros Get Market Timing Wrong

Even with professional investors, herd mentality makes successful investing a daunting task. This year, as you see prediction after prediction about a market decline, stocks have confounded the experts with solid gains. My Dividend Hunter strategy shows investors how to not fall into the “buy high, sell low” wealth destruction cycle. Last week, one of […]

The Cure for a Directionless Market

High current yields and growing dividends are the cure for the directionless market. And if we are in for a “lost decade” from the stock market, yield plus growing dividends is one strategy that will still produce positive total returns. The strategy works in any market—bull, bear, or stagnant. Let me show you. Over the […]

How This Financial Crisis Creates Opportunity

With the fall of Silicon Valley Bank, the financial news media has remained focused on finding the next “crisis” of the day. The so-called banking crisis petered out after a couple of weeks, but that didn’t stop the pundits from using it to proclaim that commercial property values and commercial mortgages would be the next […]

It’s Time to Invest in REITs

Real Estate Investment Trusts (REITs) fully participated in the 2022 bear market. Unlike the tech sector’s apparent recovery during the first quarter of 2023, REIT share prices have not shown signs of life. Broadly speaking, REITs are down about 30% from the late 2021 highs. That means now is a good time to make some […]

My Favorite ETFs for This Market

Decades ago (in the 1990s), I learned that traditional bond funds—whether ETFs, index funds, or mutual funds—would destroy investor holding values in a rising rate environment. Forty years of declining rates hid this fact from the investing public. 2022 exposed the dangers of traditional bond products. Fortunately, there is a better way to invest in […]