Markets are adjusting to competing signals rather than moving in a single, clear direction.

Interest rate expectations remain divided. Financial markets have reacted to the possibility that the Federal Reserve’s policy will remain restrictive for longer, which has supported a stronger dollar and pressured assets that benefited from easier conditions. At the same time, futures markets continue to price in roughly two interest rate cuts before the end of the year.

Those assumptions do not align, and that tension has been reflected in price behavior.

Economic data has reinforced the mixed picture. Some sectors are under strain. Manufacturing activity remains soft, and real estate continues to feel the effects of higher borrowing costs. Other areas have shown resilience. Consumer spending has remained steady. Labor markets have stayed relatively stable. Investment tied to artificial intelligence has continued to grow. Equity markets reflect that resilience even as other parts of the economy lag.

Inflation adds another layer. Housing, which carries significant weight in the consumer price index, has increasingly contributed to disinflation. Productivity gains associated with artificial intelligence are also being discussed as a potential supply side offset to inflation pressures. Recent inflation readings have moved closer to the low-2% range, though progress has not been uniform.

Jobs data remains central to how markets interpret these conditions. Expectations point to a steady unemployment rate, wage growth near 0.3 percent month over month, and modest job creation. Structural factors such as demographics and immigration constraints are likely limiting how much job growth the economy can generate. As a result, monthly payroll gains below 100,000 may become more common, even during expansion.

In this environment, markets have not produced sustained trends. Price action has unfolded in short, decisive moves as buyers and sellers reassess risk quickly. Capital has rotated rather than exited, and volatility has responded rapidly when positioning becomes crowded.

This type of backdrop places greater emphasis on timing and probability.

When long-range clarity is limited, short term signals become more valuable. Moves often occur after selling pressure has already played out and demand begins to reappear. Price adjusts first, and explanations follow later.

That is where the ITV indicator comes in.

ITV is designed to identify moments when risk has shifted in a measurable way. Rather than attempting to predict economic outcomes or market narratives, it analyzes price behavior and volatility together to assess whether downside pressure has likely been exhausted or whether risk has become asymmetric.

The indicator was developed to support disciplined decision making in markets that move in bursts rather than trends.

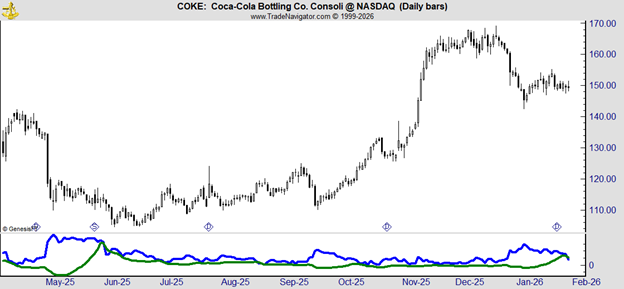

That behavior was evident in Coca-Cola Consolidated (COKE) on January 30.

Early in the session, the ITV indicator generated a buy signal. The signal reflected stabilization in price behavior and a shift in risk, not a reaction to headlines or new economic data.

COKE opened at $148.57 and closed at $152.06, representing a same-day gain of approximately 2.35%.

Moves of this size may appear modest in isolation, but they illustrate an important principle. In markets shaped by mixed signals and rapid reassessment, consistent short term gains can accumulate when they are captured with discipline.

The ITV indicator, which earned the Charles H. Dow Award for original research in technical analysis, was built to identify these repeatable moments. It does not rely on forecasts or certainty. It focuses on probability and observable price behavior.

Markets do not require constant action, but they do reward preparation. When conditions align, even a single session can provide meaningful progress.

Generate up to $5,000/month with 10X less money?

Most people think they need $1.5 million to generate $5,000 per month in retirement. But I just discovered a new way to do it with 10X less money - now anyone can hit their retirement goals with thousands, not millions.

Click here to start collecting this income (next payout coming soon)