I invest in the same stocks and other securities I recommend to my newsletter subscribers. While all three services – The Dividend Hunter, Monthly Dividend Multiplier, and Weekly Income Accelerator –focus on income-paying investments, each has a distinctly different strategy. I interact with hundreds of investors each week across all three platforms. I want to share some observations that I hope will make you a better investor.

My Dividend Hunter service offers a list of recommended high yield investments, which list includes common stocks, preferred stocks, ETFs, and closed-end funds. The diversity of investment types and common stock businesses leads to my first observation.

Investors often pick these types of investments based on the current yield and do not understand the underlying business or assets. This type of investor becomes the first to ask questions when share prices drop. Understanding the investment takes away a lot of the worries when share prices fall.

For example, one of my recommended ETFs uses a covered call strategy with a precious metal ETF as the underlying asset. I am long-term bullish on that particular metal (silver), but I field many questions from investors who don’t realize the share value tracks the price of silver.

The next observation involves my guidance on how to buy high-yield investments. With any new investment to my recommendations list, I suggest purchasing a “starter” position and building up the holding over time. I don’t try to time the market, so when I find a new, attractive, high-yield investment, I put it out to my subscribers. From that first recommendation date, the share value can go up or down. I am confident that over time, a quality, high-yield investment will generate great income and returns…but investors have to live through the dips.

I hear from investors who dump a lot of money into a newly recommended investment, and then the share price drifts lower for several months. If these investors spread out the investment over time, they would average out the cost of shares and build up their income stream month after month.

The lesson for investors is to avoid getting excited about a new investment, especially a high-yield investment, and dumping a bunch of money into the shares all at once. Space out your share purchases over four to six months. You could possibly save yourself from a lot of worries.

Finally, I often repeat that high-yield investing is about building an income stream. This goal is incompatible with market timing, stop-loss orders, and selling to lock in profits. I often say you can invest in quality high-yield investments at any point in the market cycle, and your income stream will grow. However, income-focused investors can and do build wealth by their willingness to buy into stock market corrections and bear markets. Buying income stocks when the market is down builds both the income stream and wealth when prices recover.

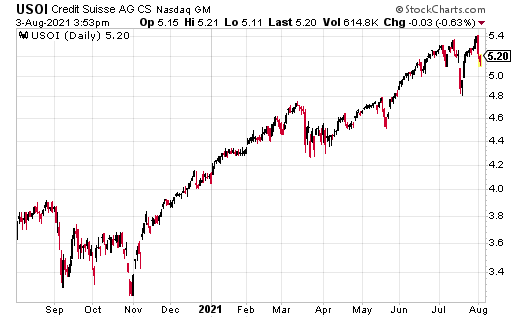

If you want to ignore these recommendations, here is a “hot,” high-yield investment pick. The X-Links™ Crude Oil Shares Covered Call ETN (USOI) sports a current 18% yield. You don’t need to research how the fund operates (what the heck is an ETN, anyway?), or its dividend history, or learn what market movements would affect the share price before you invest, right? Nah, you don’t need to do that because the yield is 18%.

(Please note that this final paragraph was written with my tongue firmly in my cheek. Do not use this strategy, whether for short or for long-term investing.)