One of the more intriguing aspects of 2021 has been the relatively high levels of expected volatility in the equities markets. The VIX, a widely-used barometer of broad market volatility, has been consistently higher throughout the year compared to its long-term median. Despite the high levels of anticipated volatility, the market hasn’t yet seen that much action.

Sure, there’s been some big up and down days. Overall though, the implied volatility (as given by the VIX), has been way higher than the actual or realized volatility. It’s possible the VIX has been unusually high because investors have been more proactive about hedging their portfolios.

After all, it hasn’t been all that long since the market crashed in March of 2020 due to COVID-19. COVID still exists, although the vaccination push has significantly slowed the spread. However, there are still global supply chain issues and other economic problems which may be concerning to stock holders.

One way to alleviate the stress of a major selloff is by hedging your portfolio with options. Doing something as simple as buying an index or ETF put can go a long way towards helping you sleep at night.

Yes, puts can be expensive, especially when the market is volatile. There are ways to lower the cost of hedging. For instance, put spreads can be used instead of straight puts. Additionally, puts can be purchased in cheaper ETFs (like sector ETFs instead of broad-based ETFs).

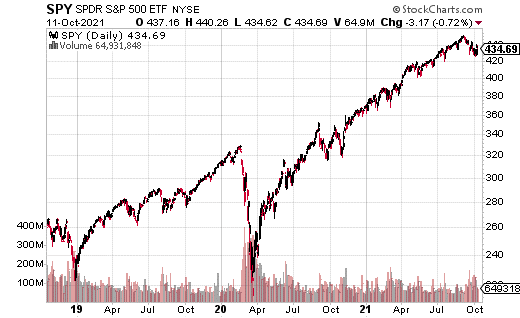

The cost of puts can vary based on how long there is until expiration and how far out of the money the puts are purchased. Let’s focus on the distance of the put strike form the stock price. We’ll look at SPDR S&P ETF Trust (SPY) as it’s the most widely traded index ETF in the world.

A correction put in SPY is one that is approximately 10% from the current price In SPY. Looking at 10% out-of-the-money puts that expire in about a month, we can see that they cost around $1.35. A crash put is 20% away from the current price. The 30-day crash put costs about $0.35.

So, it’s easy to see how the price changes as the option gets further away from the price of the stock. A crash put doesn’t cost all that much, but is highly unlikely to come into play. A correction put may come into play more often but is quite a bit more expensive.

Should you choose a correction put, a crash put, or something else entirely when you hedge? There’s not a right answer. It all depends on your risk tolerance level and available capital. At the end of the day, the most important thing to consider is what will help you sleep at night.