Inflation is defined as, “A general increase in prices and fall in the purchasing value of currency.”

Inflation is a silent killer of retirement dreams. Most retiree’s income can’t keep up with inflation; even with the social security inflation rider.

Jeff Clark’s article, “How to Deprogram Your Friends & Family from the Cult of Fiat Currency,” is a primer on inflation.

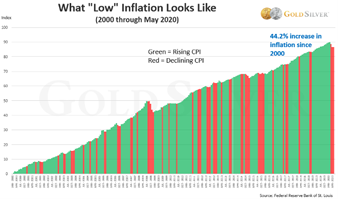

He provides this graph:

“The US dollar has lost 44.2% of its purchasing power just since the year 2000.

That means that the dollars you saved 20 years ago have lost almost half of their purchasing power. …. You’ve done nothing wrong, but there’s a serious leak in your financial boat.”

We recently interviewed Chuck Butler about the Fed’s intention to spur inflation. He chides the Bureau of Labor Statistics (BLS) continual changes in how inflation is calculated, concluding, “The government calculator is on the fritz!”

The BLS is the official (biased) scorekeeper, the fed is hell-bent on increasing inflation even more while interest rates remain at historic lows.

Chuck’s answer for those trying to safely navigate this investing minefield?

“Diversification reduces the overall risk considerably. If you follow the Modern Portfolio Theory of H. Markowitz, you will only achieve true diversification when you invest in all asset classes, including currencies and metals.”

We’ve discussed metals and stocks. Today I want to focus on currencies.

DENNIS: Chuck, on behalf of our readers, thanks once again for your help.

As you’ve explained, when inflation hits, the currency is like the game “hot potato”, nobody wants to hold it. Investors dump the hot potato currency and grab another hoping not to lose money.

We were taught that inflation was caused by increases in the money supply. Since 2008 our government created trillions of make-believe dollars. I feel major central banks harmonized their debt creation, maintaining some relative parity. World currency supply increased a lot, but inflation is still under control.

Is holding some foreign currency still a good diversification alternative?

CHUCK: Thanks again Dennis for the invitation to speak my mind!

Yes, but with a caveat… A couple of months ago, I wrote a Pfennig For Your Thoughts letter, concluding that the current run up of debt among most nations will eventually cause them to default on their debt, and that won’t be taken lightly by currency traders…

Understanding that, our goal is to find currencies that haven’t played this game; run up debts and print currency to pay for it. In can be done. To answer your question, I think yes, some currencies are a good diversification tool.

DENNIS: If the dollar approached the “hot potato” phase, what would be safe alternatives? Wouldn’t the EU, Japan and China just keep creating money also?

CHUCK: Yes, they will. But… the dollar has offset currencies; Euros and yen. And no matter what the problems are in the European Union (EU) or Japan, those currencies will still act as offset currencies when the dollar gets sold.

Beyond those two, I would look to a country like Russia. They have not joined in on the currency printing, debt run up like other countries. Currently the Russian debt to GDP runs at 16%. For the first time since the economic sanctions were placed on Russia by the EU and the U.S., their public debt is zero.

On the other hand, the U.S. has a debt to GDP ratio of: 107%; and that’s before the spending lollapalooza on the pandemic. Japan has the highest Debt to GDP ratio of: 253%, and Greece is 181%…

If the U.S. and the EU ever gets their heads out of their you-know-whats, and drop the economic sanctions on Russia, the Russian economy will grow like a weed. Right now, the ruble is being traded downward because of these sanctions and the lower price of Oil. Remove sanctions and improving oil prices will turn that downward ship around.

Some other alternative currencies have pretty good fundamentals; including the Norwegian krone, Swedish krona, and Singapore dollars.

DENNIS: The major currencies are maintaining parity; yet gold prices are rising. Is gold the one safe haven people all over the world are heading for?

While gold is the ultimate inflation hedge, I’m not comfortable putting too many eggs in that basket.

CHUCK: Dennis… we recently discussed diversification of one’s investment portfolio. While it seems to be a good idea to load up on Gold & Silver right now, with all the currency printing and debt accumulation going on, I wouldn’t advise anyone to go “all-in” on any asset class….

Right now, even that guy that says “just buy stocks” the armchair quarterback guy, will be sorry when stocks turn against him – and they will. Diversification is much more than just owning a wide range of stocks.

DENNIS: Many countries have negative interest rates. We have a little money offshore and I don’t want to be charged for holding cash or buying negative interest bonds. We have tried to find some safe stocks, denominated in foreign currency, that are at least paying some dividends.

Do you see this as a viable alternative?

CHUCK: Yes, when diversifying out of the dollar, there are three ways it can be done. One of those ways is with foreign stocks denominated in the currency of the country the stock is located. I hear there are some brokerage houses in the U.S. that allow investors to denominate any stock in a foreign currency. They probably only use the majors, like: euro, yen and sterling. It doesn’t hurt to call and ask….

I’ve always shied away from foreign stocks, because besides Nestle, what do I know about foreign companies? I would have to do a ton a research, and quite frankly, I never had the time to do that. However, denominating U.S. stocks in a foreign currency takes out that research requirement!

DENNIS: What are some other ways readers could invest in foreign currency, while keeping their money inside the US?

CHUCK: In addition to denominating stocks in foreign currencies, you can own the currency outright, in a CD or money market account. Right now, you’ll have to pay up for holding negative interest currencies, like euros, yen, francs, etc. (Russia still pays interest!)

Also, there are currency ETF’s…. check them out, it’s not like owning the real currency, but the ETF does mimic the currency’s performance…

The great thing about owning the actual currency is that you can use it abroad if you need to. Once we get back to traveling abroad, you’ll want to pay in the local currency. This can be done using foreign wires, drafts, etc.

I don’t like to go off on tangents, but I need to tell you this. Years ago, before the euro, there were Americans that bought gliders made in Germany. They would come to us, buy the D-Marks and hold them until it was time to pay for their glider. Many times, the D-Mark appreciated. That sure made owning a currency for a future endeavor easy!

DENNIS: My online broker tells me they allow clients to hold foreign stocks, denominated in other currencies, in special accounts. Interested readers should discuss this with their broker.

You mentioned an oil play and Norwegian Krone. Statoil is a Norwegian owned oil company. (This is not a recommendation.) Might a company like this be an example for readers?

Do you have any suggestions here?

CHUCK: Once again, research is very important when buying a foreign company’s stock… But yes, the Statoil is a good example. Another would be CEMEX (the Mexican cement co.). I also mentioned Nestle in Swiss francs.

There are other strong possibilities here folks, but you have to find them by researching. I Googled this and Wikipedia lists the foreign state-owned companies by country!

That’ll give the name of the company, but research into is still needed!

DENNIS: One final question. To follow Mr. Markowitz, and diversify for safety, do you have a recommended percentage that you recommend being held in foreign currency?

CHUCK: Thanks again for inviting me.

Before answering your question, I’d like to add one thing. The more the Fed talks about creating inflation, the more the need for investors to hedge their bets; get some money out of US dollars and beat the crowd. Some may be in gold, but some should be in currencies that will rise as the dollar falls.

I come from a history of bank investment areas that always had a conservative approach to asset allocation. I’ve always said that 10-15% of any asset allocation is suffice. And you can move that up to 20-25% if the asset is in a real strong trend rally.

So, using that information, I presently have a portfolio allocation that looks like this:

20% in Gold & Silver

20% in stocks with a further diversification of that asset class among: tech, mining, and long-term growth.

15% in bonds…. (municipal bonds AAA rated, and very short term)

10% in an annuity

15% in land

10% in currencies

And the rest in cash, that can be used at a moment’s notice to buy something that looks good….

Dennis here…

I feel age and portfolio size are major factors. Younger investors are concerned about growing wealth, retirees focus on preserving wealth – so the percentages may change somewhat.

Holding your nest egg in one currency is “all in” and risky. Diversify – hedge your bets!