ON Semiconductor (ON) shares have been on a roll this month after announcing a blowout quarter that exceeded Wall Street’s forecasts. The company is a leading supplier of power and analog semiconductors, as well as imaging sensors—a white-hot market of late. One of the biggest developments to ON’s solid quarter was the company’s concentrated effort […]

One Way To Trade CSCO After It Missed Earnings

Networking giant Cisco Systems (CSCO) dropped 5% the day after earnings were released last week. The company’s’ guidance was disappointing to investors and revenues were lower than expected. However, one trader used this opportunity to enter a covered call trade. The trader purchased 1.35 million shares of CSCO (at $51.77) while selling 13,500 calls that […]

Trade of the Week: LCID

There’s been a crazy amount of options action in recent days in the electric vehicle industry. Lucid Group (LCID) is one of the latest EV stocks to get lots of attention by traders. The new company has a market cap larger than Ford (F), at least for the time being. On a day when over […]

The Only “Covid Recovery” Stock You’ll Need

Dear Reader, I have seen and heard about a wide range of stocks that investment pundits recommend you buy to profit from the recovery from the coronavirus pandemic. With stock prices zooming higher through 2021, it’s hard to determine which “recovery” stocks still have room to run. Here is one that will do very well […]

Here’s Why the Roblox Stock Price Is Up 60% In Just the Last Week

Investors may want to pay close attention to the metaverse. As Meta Platforms’ (FB) Mark Zuckerberg defines it, according to CNBC, the metaverse is “a sci-fi concept whereby humans put on some sort of headset or smart glasses that allow them to live, work, and play in a virtual world.” Granted, the metaverse isn’t “alive” […]

Are Retail Stocks About to Take Off Before Christmas?

I’m looking at the retail sector right now, and I have a few ideas to try and play it. Many retailers are reporting strong customer traffic, but does that mean we’ll see a Santa Claus rally in retail plays? I’m looking at ONE stock in particular that could be a great play. I shot a […]

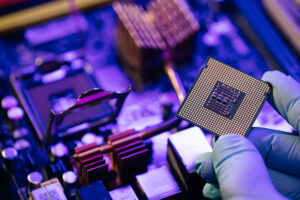

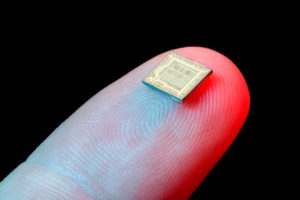

A Good Semiconductor Stock to Buy During the Chip Shortage

According to NVIDIA CEO Jensen Huang, for example, demand could exceed supply through 2022. Intel CEO Pat Gelsinger says the shortage won’t end until 2023. “We’re in the worst of it now, every quarter, next year we’ll get incrementally better, but they’re not going to have supply-demand balance until 2023,” he told The Independent. STMicro […]

Why Stock Buybacks Do Nothing for You

Dear Reader, Corporations’ renewed focus on “returning cash to shareholders” is laudable, but misleading. As with all things investment-related, you can only determine whether something is a good deal for investors by understanding the nuances of how companies implement these policies. When business results are good, corporate boards of directors often choose (as they should) […]

Metaverse Winner: Facebook or Roblox?

Roundhill Ball Metaverse ETF (META) has doubled its net asset value from $130 million to $260 million since Facebook (FB) changed its name to Meta Platforms two weeks ago. Volumes have also soared on the ETF. It may have been a serendipitous case of being in the right place at the right time for the […]

PayPal Shares Continue to Struggle After Near Takeover of Pinterest

Shares of PayPal (PYPL) have lost a third of their value since peaking above the $310 level in late July. Much of the selling pressure has come from a couple of missteps, like its near-acquisition of Pinterest (PINS) and disappointing guidance following PYPL’s most recent earnings report. To start, PYPL’s interest in PINS was a […]