A lot of attention has been paid to the big tech companies this year, and rightly so. Big tech is leading the market to record highs, despite what the coronavirus pandemic has done (and continues to do) to the global economy. Precious metals are another area getting a lot of space in the financial press.

But in my opinion, the most exciting stocks in the market right now are electric vehicle (EV) companies. Unlike big tech companies and precious metals, there isn’t much in the way of fundamentals to support the surge in electric vehicle stocks. It’s all hype and future promise.

You see, big tech has actually done really well in 2020. Revenue and profits are growing for most of the big players in this space, like Apple (AAPL), Amazon (AMZN), and Microsoft (MSFT). Additionally, precious metals make sense for those looking for a store of value in a world of negative real interest rates (interest rates minus inflation).

Electric vehicle makers, on the other hand, are mostly making very small profits or not making money at all. Look at Tesla (TSLA), the market leader. The company’s stock price is around $2,000 a share (up a whopping 384% year-to-date). That means it has a market cap of $368 billion with profits of… $368 million (that’s over 1,000x P/E). At least TSLA is selling vehicles at a rapid clip. Some of the smaller players haven’t ever sold one car or truck.

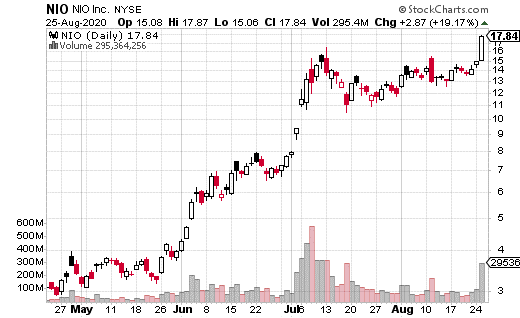

Another EV company that is having a monster year and has actually sold a product is NIO (NIO). NIO is billed as the Tesla of China. The stock has gotten noticed by the hype crowd and is up 343% for the year. The company does have over $1 billion in sales; still, NIO isn’t earning a profit, and it’s trading at 19x sales (which is crazy high).

Just recently, the stock spiked from about $15 to $18 on a positive upgrade from a UBS analyst. The analyst raised the price target from $1 to $16 on improved fundamentals; however, the stock is trading close to $18, so I’m not sure that price target means all that much.

Usually, I would suggest this is a put-buying opportunity, but you never know in this market. This is especially true with EV companies in a bubble. It’s hard to know how long bubbles can last until they’ve already popped.

The options market is supporting the stock price of NIO at the moment. While its options are typically the realm of smaller traders, it looks like a big fund or trader took notice of NIO after the recent upgrade.

This trader bought roughly 12,000 September 19 calls, with the stock trading just over $16. These calls were purchased in four large blocks, with prices ranging from about $0.80 up to $1.10. Generally speaking, NIO needs to climb above $20 in the next three weeks for these calls to pay off.

Essentially, this is a million-dollar bet that NIO is going to keep climbing well over its UBS target price of $16. Despite the irrational valuation, it seems like at least one institutional investor thinks the good times will continue. I’m not sure I agree with that sentiment, but it’s hard to argue with the tape.