Global pandemics and civil unrest don’t seem to impact stock prices, but it remains challenging to find yield in a world of near-zero interest rates. Central banks are doing everything they can to keep global economies from crashing (which is the main reason stock prices are stable), and the result is that yield can’t be found in traditional vehicles, like bonds.

After all, who wants a 10-year Treasury note that pays a whopping 0.68% yield? It’s not much different than putting your money under a mattress at that point (except for the safety part—that, and piles of cash may not be all that comfortable to sleep on).

Investors are forced to look into alternative strategies for collecting yields. These include riskier bonds, stocks, and derivatives. One reason investors continue to buy stocks is due to the dividend yield. Even with the March crash, the huge difference between dividend yields and bond yields means stocks remain attractive.

Another source of income is through derivative strategies. In particular, covered calls have become extremely popular over the last decade. Selling calls on stocks (that are already owned by the investor) is a reasonably safe way to generate additional yield. In some cases, the stock is bought and the calls are sold at the same time, often called a buy/write.

Sometimes a buy/write is designed to provide income while allowing for upside appreciation of the stock. In other cases, the buy/write is focused primarily on generating income.

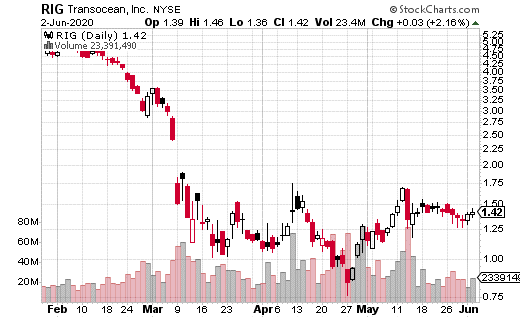

Recently, a large trader or fund used Transocean (RIG) in a buy/write trade designed for the income component. With Transocean trading for $1.43, the trader bought 1 million shares and sold 10,000 June 19th 1.50 calls for $0.10 to complete the buy/write.

Let’s break this trade down: It may not seem like 10 cents is worth collecting, but with 10,000 calls, it amounts to $100,000. More importantly, with the stock at $1.43, it amounts to 7% yield in just under three weeks. On an annualized basis, that would be over 140%.

There’s not a whole lot of downside risk with RIG at such a low price. Plus, the company isn’t likely to go bankrupt in the next three weeks. The trade does provide seven cents of upside potential should the stock climb. If Transocean is at $1.50 or above at expiration, the total return will amount to 12%.

Should you make a trade like this to enhance yield? That depends. It probably doesn’t make a whole lot of sense unless you can place this particular position for size. Buying 100 shares and selling one call will generate just $10 before fees. However, buying 1,000 shares and selling 10 calls for $100 may make more sense, especially since it’s only a three-week trade.

What’s important to recognize is that yield can come from unexpected places. Using a $1.42 stock to generate 7% yield in three weeks is out-of-the-box thinking. It’s the sort of strategy investors need to consider with no obvious sources of yield in traditional assets.