Through 2024, the energy midstream sector had posted four consecutive years of double-digit total returns, including a massive 40% gain in 2024. The broad North American midstream benchmark, the Alerian Midstream Energy Index, posted a 5.0% return in 2025. Midstream lagged the broader energy sector, which was up 8.0%, and both were well behind the […]

Master Limited Partnerships (MLPs)

Take Advantage of Energy Midstream On Sale

Last week, the price of WTI crude tumbled from $66.42 to $62.46 (a 6% drop) in just a couple of days. When the price of oil drops sharply, so do the share prices of energy stocks. If you know the types of energy companies to buy, buying the dip will pay off handsomely. The energy […]

Excellent Dividend Growth from Energy Midstream

Energy midstream stocks, including master limited partnerships (MLPs), have been an excellent option for investors seeking yield and dividend growth. With the second-quarter earnings season behind us, it’s a good time to see how the sector is doing with dividends. Alerian Energy, now part of VettaFi, publishes indexes that track energy midstream and infrastructure assets. […]

Strong Dividend Growth From Energy Midstream

Known for dividends and attractive yields, energy midstream stocks have been a hot stock sector for the last five years. For example, the Global X MLP & Energy Infrastructure ETF (MLPX) returned 239% over the last five years. The 2025 bear market (mid-February through early April) saw the midstream sector drop by 20%, similar to […]

Number One Energy Midstream Stock To Lock In Yield and Growth

Operations in the energy sector can be divided into three distinct subsectors: upstream, midstream, and downstream. Profits from two of them—upstream and downstream—vary significantly, with price changes for crude oil, natural gas, and refined fuels. The third sector, midstream, has stable revenue streams and makes a good choice for income-focused investors. Major energy companies like […]

7% Yield and Consistent Dividend Growth

An attractive yield plus solid dividend growth is a surefire strategy for building investment income and wealth. Energy midstream stocks offer a hard-to-beat combination of yield and dividend increases for investors who want to follow this strategy. Energy infrastructure/midstream companies are split pretty evenly between those organized as Master Limited Partnerships (MLPs) and C-corporations. Managed […]

Why the Shrinking Number of MLPs is Great for Income Investors

Last week the news included announced acquisitions of two master limited partnerships (MLPs). That brings the total to three MLPs that will disappear by the end of the year. The number of MLPs has been shrinking for almost a decade, leaving only the strongest operating. That’s good news for us income investors. Here’s why… As […]

Why High-Yield MLPs Like This One Have a Bright Future

Over the last decade, the master limited partnership (MLP) sector has undergone a deep, multi-year downturn and then a massive recovery. After all that volatility, you might wonder if the sector’s high yields are worth it. Let me show you where I see MLPs going from here… The Downturn From mid-2014 until January 2016, crude […]

The Yin and Yang of Energy Midstream Stocks

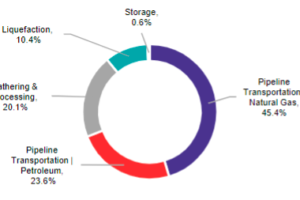

In these uncertain times for investors, energy midstream stocks offer an island of stability. This sector provides an attractive combination of current yield and dividend growth. However, midstream companies divide into two distinct categories, and the differences are important. Energy midstream covers the movement and storage of energy commodities from the upstream drillers to the […]

The Cure for a Directionless Market

High current yields and growing dividends are the cure for the directionless market. And if we are in for a “lost decade” from the stock market, yield plus growing dividends is one strategy that will still produce positive total returns. The strategy works in any market—bull, bear, or stagnant. Let me show you. Over the […]