Out of the couple of hundred publicly traded high-yield, option-strategy exchange-traded funds (ETFs), the YieldMax Ultra Option Income Strategy ETF (ULTY) is the one about which I get the most questions. And ULTY is not a recommended ETF in any of my newsletter portfolios.

ULTY aims to achieve a high distribution yield (currently 83.56%, as of this writing) by owning a portfolio of high-volatility stocks. More volatility means larger option premiums, which fund managers trade to generate the cash needed to pay dividends. Investors who may not know much about this type of ETF are attracted to the very high yield.

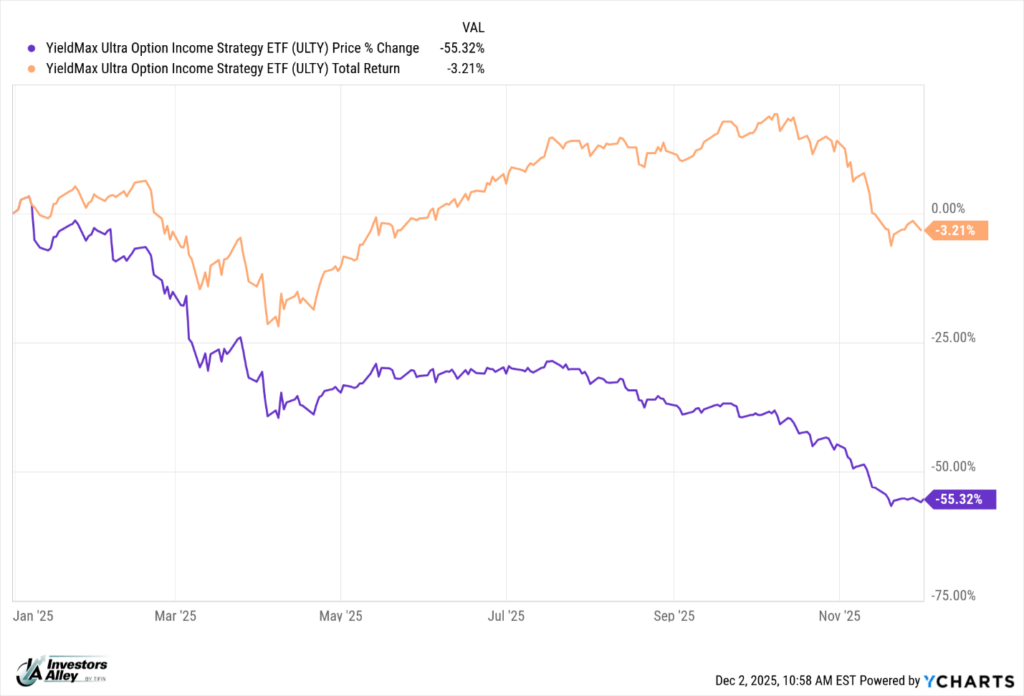

ULTY’s problem has been share price or NAV erosion, which offset a large portion of the distribution yield. Here is the year-to-date chart showing the declining share price and a total return close to breakeven. YieldMax recently performed a one-for-ten reverse stock split with ULTY.

Investor disappointment in ULTY is understandable.

On October 31, REX shares launched its REX IncomeMax Option Strategy ETF (ULTI). ULTI does not have a published distribution rate, but based on the early dividends, the current yield is about 40%. The website provides this description:

The REX IncomeMax™ Option Strategy ETF is a sophisticated strategy targeting the market’s most volatile U.S. stocks with an options strategy that dynamically adjusts to changing market conditions. By implementing and managing a mix of put and call positions on these stocks, ULTI seeks to turn volatility into weekly income with downside mitigation against extreme market swings through active positioning.

So far, during its very short time in the market, ULTI is down 30.20%.

On October 30, Kurv Invest launched its own answer to ULTI. The Kurv High Income ETF (KYLD) seeks to pay a high current yield while maintaining a stable NAV. Based on the early dividends, KYLD yields about 37%. Over its five-week life to date, the fund has returned 8.68%.

Interesting that ULTI and KYLD launched at the same time and have similar yields. KYLD’s outperformance shows that good investment management can make a difference.

Tim Plaehn Is Giving Away His #1 Growth Stock Pick Today (Up 159%)

No paywall. No credit card. Just click and get the ticker. Tim reveals the exact stock-and the signal that's spotted 37 winners-inside his free Velocity Surge presentation. Click here now to get the name and ticker.