Now is the time to lock in a future that includes once in a generation opportunity for future financial security. The goal is to lock in income investments – using high-yield dividend stocks – that will pay up to 20% yields for life.

A waterfall of events led to a crash in the values of high-yield investments such as real estate investment trusts (REITs), master limited partnerships (MLPs), business development companies (BDCs), and preferred stock shares.

Here’s How Dividend Investors Are Setting Up Plans to Boost Their Income In A Short Time

Here is the history of the 2020 first quarter in bullet point format:

- China announces the outbreak of a new, very contagious virus. The coronavirus spreads rapidly, even from those without symptoms. The mortality rate is several times higher than from the flu.

- The price of crude oil starts to fall on the fear of demand destruction as China shuts in one of its most populous and commercially important provinces.

- The western countries fail to stop the spread of COVID-19 as travelers bring the virus to the U.S. and Europe.

- U.S. investors realized the spread of COVID-19 would lead to economic distress.

- From record-high closes on February 19 for the major stock market indexes, the U.S. markets quickly tumbled into bear market territory, with those indexes down 25% in just three weeks. This was a record short time to move into a bear market.

- In March, OPEC’s talks with Russia broke down. Saudi Arabia announced it would no longer abide by previous production agreements and would start shipping the maximum amount of oil it could produce. This price war with Russia caused crude oil to drop to $20 a barrel, a price not seen for decades.

- Energy sector stocks fell even further, with many down more than 50% compared to the values at the start of 2020.

- The deep bear market and energy sector deep crash produced a crisis for leveraged, income-focused closed-end funds, ETFs, and ETNs.

- The week of March 17, UBS forcibly redeemed a dozen popular 2X leveraged ETNs in the high yield sectors of mortgage REITs, MLPs, BDCs, and preferred stock shares. On March 17 alone, the MLP sector dropped by 50% as shares were dumped into the market by failing funds.

From this timeline, I hope you see how a series of loosely related events conspired to push stock prices in high-yield sectors down to, when they finally bottomed, tremendous drops from the share values at the start of the year. However, these events, in most part, have not affected the businesses of the companies represented by the shares.

We have a once in a decade… maybe once in a generation buying opportunity.

A Dividend Stock With a Growing Dividend Just Started Paying More

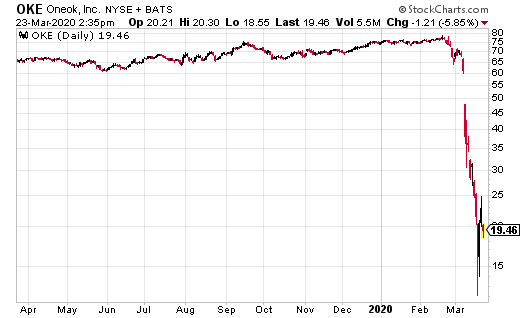

For example, ONEOK, Inc. (OKE) is the class of the energy midstream services sector. This company provides gathering, processing, transport, and storage services between producers and users of natural gas and natural gas liquids (NGLs). ONEOK’s business is not affected by energy commodity prices. The stock price has been a rock over the last four years, while other energy infrastructure companies faced a host of challenges.

ONEOK has grown its dividend every year since 1989. Historically OKE shares have been priced to yield 4.5% to 6%. The series of events listed above conspired to push the OKE share price down from $75 in February to a low of $12 on March 18. At that point, shares of this top-notch, five-star, dividend-paying company had a yield of 30%. Total madness!

36-Month Accelerated Income Plan PAYS YOUR BILLS FOR LIFE

As I write this, two days after the March 18 high-yield Armageddon, the OKE share price has recovered into the low $20’s. This is a stock you can buy now, which will pay an 18% dividend yield on cost, and grow the dividends over time.

ONEOK is just an example out of many stocks that have been beaten down by the events of February and March 2020. Many great companies now have shares priced to yield 12%, 15% and even 20%. These are yields you can lock in now for a lifetime of high cash income returns.