The individual stimulus checks from the Federal government CARES Act are expected to hit the bank account of most Americans within the next few weeks.

The payments will be $1,200 for individuals, $2,400 for a couple, and $3,000 for a family of four. This could help those who now have to adjust their retirement income planning.

Related: Government Stimulus Check 2020 Status

If your financial position is stable, and the stimulus check will be some bonus money, consider investing the money into something with high return potential. The new bear market has uncovered opportunities in relatively safe investments that could double your money in a year and pay a high dividend yield along the way.

When the stock market crashes, it takes the good down with the average and the bad. Preferred stock shares are one type of income investment that, in regular times, are very stable and pay attractive dividends. In this market crash, preferreds have also declined. Many preferred shares are down 25% to 50%. When the economy gets back on track, I expect preferreds to have one of the quickest value recoveries.

If You Sold Stocks for Losses, Buy These Dividend Stocks With The Cash[ad]

Preferred shares get the name from their preference for dividend payments over common share dividends. The preferred definition means a company cannot reduce or eliminate preferred stock dividends if they want to pay a dividend on common stock shares. As long as a company is paying any level of common stock dividends, the preferred dividend is secure.

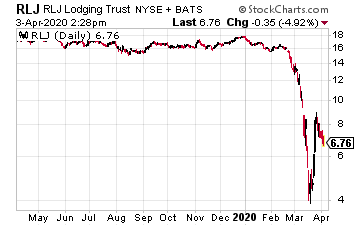

For example, do to the economic shutdown, lodging REIT, RLJ Lodging Trust (RLJ), reduced its regular dividend from $0.33 per share down to $0.01 per share. The fact that a dividend will be paid on the RLJ common shares means the $0.4875 dividend on the RLJ Lodging Trust Preferred A (RLJ.PA) shares is secure.

Despite the security of the dividend payments, the RLJ.PA share price has dropped from $29 to $17 since late February. When the hotel industry gets back to regular business, the preferred shares will quickly climb back about $25.

Individual preferred shares can be complicated. Most have added characteristics, which may include fixed-to-adjustable, cumulative, convertible, and callable attributes. It takes some study time to understand the different features that preferred stock has or does not have. I explained these preferred stock characteristics in the April 2020 issue of my Dividend Hunter newsletter.

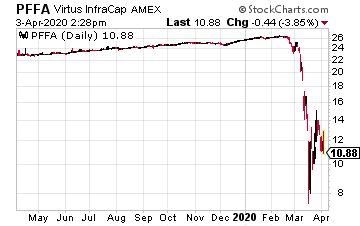

For a preferred stock investment that could double over the next 12 months, take a look at the Virtus InfraCap U.S. Preferred Stock ETF (PFFA). This ETF pays monthly dividends and currently yields in the mid-teens. A return to normal would take the PFFA share price into the mid-$20s from $12 range where it now trades: roughly a 100% return.