In March and April, the pandemic-triggered stock market crash hit the high-yield investment sectors, especially hard. Exchange-traded funds and notes (ETFs, ETNs) lost up to 90% of their value in a very short time.

UBS to Redeem Two Leveraged Mortgage ETNs After 95% Plunge

“Leveraged” is the word to note. Before the COVID crisis, there were numerous funds, also including closed-end funds (CEFs) that used leverage to boost returns. However, when share prices started to fall, these funds were forced to begin selling to maintain their target leverage. The more they sold, the more prices fell, requiring still more selling. It was a vicious cycle that affected the high-yield sectors such as MLPs, REITs, preferred shares, high-yield bonds, and BDCs.

UBS was a prime culprit during the high-yield crash. The company threw in the towel, and between March 10 and March 27, the finance giant announced the liquidation of over a dozen leveraged ETNs. Here are some representative fund names that were closed:

- ETRACS 2xMonthly Leveraged Alerian MLP Infrastructure Index ETN

- ETRACS Monthly Pay 2xLeveraged US Small Cap High Dividend ETN

- ETRACS 2xMonthly Leveraged S&P MLP Index ETN

- 2×Leveraged Long ETRACS Wells Fargo® Business Development Company Index ETN

- ETRACS Monthly Pay 2xLeveraged Mortgage REIT ETN

- ETRACS Monthly Pay 2xLeveraged US High Dividend Low Volatility ETN

- ETRACS Monthly Pay 2xLeveraged Wells Fargo MLP Ex-Energy ETN

- ETRACS Monthly Pay 2xLeveraged Diversified High Income ETN

- ETRACS Monthly Pay 2xLeveraged Closed-End Fund ETN

- ETRACS Monthly Pay 2xLeveraged MSCI US REIT Index ETN

Buy the #1 stock to turn $25k into tens of thousands of dollars for life

I’ve identified a stock that will be your cash register for the next 30 years.

But don’t just buy shares to claim your income. Do this one thing with this one stock.

I think you can see how the redemption of these funds resulted in the dumping of high-yield investments into the market with no regard for fundamental values.

The high-yield sectors, such as master limited partnerships (MLPs) and real estate investment trusts (REITs), had substantial share price gains in April, May, and early June. However, because they fell so far in March, many of these stocks remain 30% to 40% below their January 2020 levels.

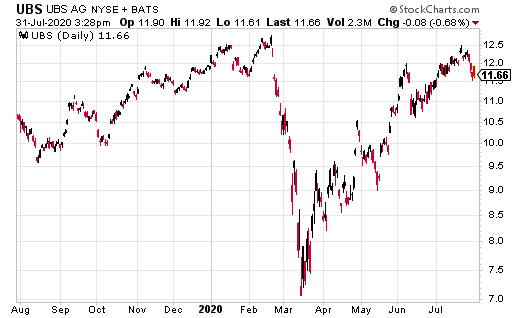

After so much wealth destruction due to the structure of these leveraged funds, imagine my shock when I learned that UBS announced a return to the leveraged ETN market. These are its new funds:

- ETRACS Quarterly Pay 1.5X Leveraged Alerian MLP Index (MLPR)

- ETRACS Quarterly Pay 1.5X Leveraged Wells Fargo BDC Index (BDCX)

- ETRACS Monthly Pay 1.5X Leveraged Mortgage REIT (MVRL)

- ETRACS Monthly Pay 2x Leveraged Closed-End Fund ETN (CEFL)

UBS has no shame and obviously wants to get back to collecting management fees from these dangerous funds with yields that appeal to uninformed investors. It is a scary development.

The silver lining is that there are tremendous opportunities from individual companies and stocks in these sectors. For my Dividend Hunter subscribers, I have researched and recommended the best in class from the MLP, BDC, mortgage REIT, and CEF sectors.