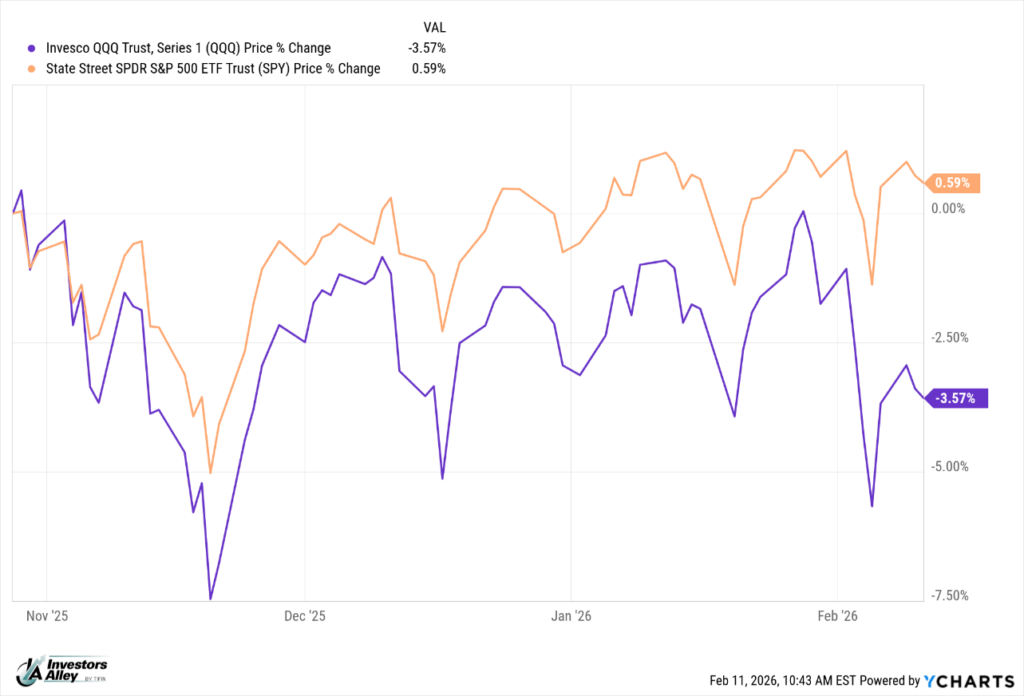

The major stock market indices peaked at the end of October 2025 and have essentially moved sideways, with considerable volatility, for the last three and a half months. You can see it graphically with the charted returns of QQQ and SPY.

The option strategy ETFs with QQQ or SPY as their underlying assets are outperforming the index ETFs, whose returns were in the low single digits. For example, the Global X Nasdaq 100 Covered Call ETF (QYLD) returned 5.5%. The Global X S&P 500 Covered Call ETF (XYLD) returned 5.6%. These two were the top funds among those with QQQ or SPY as their underlying assets.

There has been a rotation away from the large tech stocks that powered the market over the previous three years. Basic materials, energy, and industrials have been the top-performing S&P market sectors this year.

Small-cap stocks are outperforming, with the iShares Russell 2000 ETF (IWM) up 6.9% year to date, compared with 1.5% for SPY and a 0.4% decline for QQQ.

Option-strategy ETFs that cover other asset classes or market sectors have outperformed. You won’t be surprised that precious metals ETFs performed very well. The Kurv Silver Enhanced Income ETF (KSLV) led the pack returning 72%. The Simplify Gold Strategy PLUS Income ETF (YGLD) returned 34%.

Across other stock market sectors, the YieldMax Target 12 Semiconductor Option Income ETF (SOXY) returned 20.0%, and the Amplify CWP International Enhanced Dividend Income ETF (IDVO) delivered a 16.0% total return since the end of October.

For small caps, the Overlay Shares Small Cap Equity ETF (OVS) returned 14.3%.

While I believe the large-cap stocks represented by QQQ and SPY will be strong long-term performers, other sector- or asset-class ETFs can add returns to your portfolio.

What's Your Freedom Number?

It's the exact amount of monthly income you need to never worry about money again. Thanks to a revolutionary new investment it could help you reach YOUR number faster than you thought possible. Watch the Free Presentation.