Solar stocks have been some of the hottest opportunities on the market.

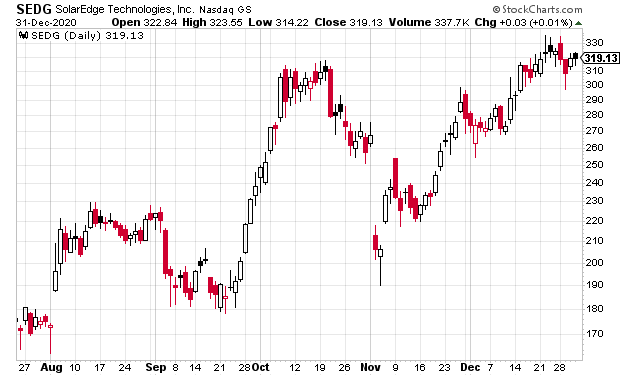

Look at SolarEdge Technologies (SEDG) for example.

Over the last few weeks, the SEDG stock price jumped from a Nov. 2020 low of $220 to a recent high of $326.66. From here, the stock could potentially see higher highs on a few big catalysts. Looking back further it started the year at $95.09 after an impressive run-up in 2019.

For one, “A Biden administration will mean more regulatory scrutiny for financial and energy stocks and probably higher taxes across the board,” says Rodney Johnson, president of economic research firm HS Dent Publishing, as quoted by Kiplinger. “But there will be opportunities. Infrastructure spending, green energy and health care are all Democratic priorities and should do well under a Biden presidency.”

Two, Biden has already said the U.S. will rejoin the Paris Climate Accord.

Three, Biden mentioned $2 trillion clean energy plan, with hopes for net zero emissions by 2050.

Four, the $900 billion stimulus bill includes $35.2 billion for new energy initiatives.

In fact, according to The Washington Post:

“It authorizes a sweeping set of new renewable energy measures, including tax credit extensions and new research and development programs for solar, wind and energy storage; funding for energy efficiency projects; upgrades to the electric grid and a new commitment to research on removing carbon from the atmosphere. And it reauthorizes an Environmental Protection Agency program to curb emissions from diesel engines.”

Q3 Earnings Were Impressive, Too

The Company reported revenues of $338.1 million, up 2% from $331.9 million in the prior quarter and down 18% from $410.6 million in the same quarter last year. Revenues related to the solar business were $312.5 million, up 1% from $310.1 million in the prior quarter and down 19% from $387.8 million in the same quarter last year. GAAP gross margin was 32.0%, up from 31.0% in the prior quarter and down from 33.9% year over year. Non-GAAP gross margin was 33.5%, up from 32.4% in the prior quarter and down from 35.1% year over year.

“Our third quarter results reflect significant growth in Europe, despite the current economic slowdown caused by the global pandemic,” said Zivi Lando, CEO of SolarEdge. “Our solar business outside the U.S. reached an all-time high and the U.S. market is showing signs of return to pre-pandemic installation levels. In our non-solar business, our e-Mobility team is gearing up to deliver to our customer the first significant batch of full powertrain solutions for assembly in electric vehicles in the fourth quarter. In addition to continuing to generate significant cash from operations this quarter, we raised $618 million, net of expenses, in convertible debt providing additional support for our continued organic and non-organic growth.”

Ian Cooper’s Personal Position in SEDG: None