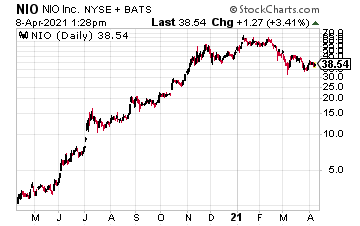

Nio Inc. (NIO) recently reported it delivered 7,257 vehicles in March 2021, a new monthly record representing a strong 373% year-over-year growth. In addition, NIO delivered 20,060 vehicles in the first quarter of 2021, a new quarterly record representing an increase of 423% year-over-year.

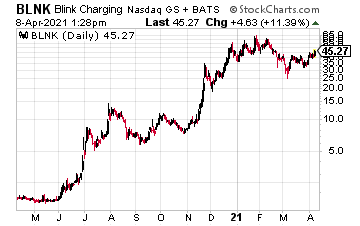

Blink Charging Co. (BLNK) ran a bit more this week after President Biden made charging stations a top priority in his $2 trillion infrastructure plans.

“AlixPartners estimates $300 billion will be needed to build out a global charging network to accommodate the expected growth of EVs by 2030, including $50 billion in the U.S. alone,” reports CNBC. In addition, the U.S. Senate just introduced the Securing America’s Clean Fuels Infrastructure Act, which would invest more money in clean vehicle infrastructure, including hydrogen refueling stations and electric vehicle charging stations.

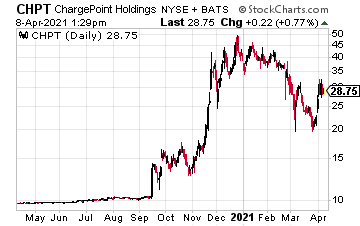

ChargePoint Holdings Inc. (CHPT) is also running on Biden’s support of charging stations.

Also, CHPT and NATSO just announced “significant progress in the first year of the National Highway Charging Collaborative, an initiative that will leverage $1 billion in public and private capital to deploy charging at more than 4,000 travel plazas and fuel stops serving highway travelers and rural communities nationwide by 2030,” as noted in a company press release.

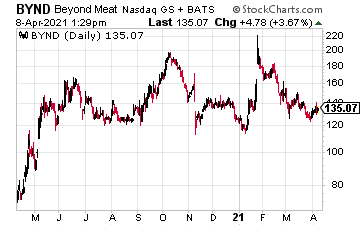

Oversold, Beyond Met (BYND) caught support just below $134 a share. BYND is gaining momentum on news it opened a “manufacturing facility in the Jiaxing Economic & Technological Development Zone (JXEDZ) near Shanghai. As Beyond Meat’s first end-to-end manufacturing facility outside the U.S., the cutting-edge plant in Jiaxing is expected to significantly increase the speed and scale in which the company can produce and distribute its products within the region while also improving Beyond Meat’s cost structure and sustainability of operations,” as noted in a company press release.

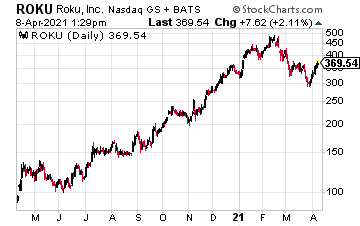

Roku Inc. (ROKU) rocketed higher after Truist Securities’ analyst Matthew Thornton upgraded the stock to a buy rating from a hold. He argues the stock’s valuation is now more “tenable” and that ROKU has attractive opportunities ahead of it.

“Thornton sees the potential for gross-profit upside in Roku’s platform business with a model that is above the consensus view on that metric for the first and second quarters of 2021, as well as the whole of 2021 and 2022. Thinking more long term, he’s also excited about the opportunities that could exist in e-commerce tie-ins that would let customers use their stored card credentials to buy items that they saw in shows or sporting events they watched through the Roku platform,” are reported by MarketWatch.

At the time of this writing, Ian Cooper did not hold a position in any of the mentioned stocks.