In the middle of last month, I spent two days on the road to pick up a new travel trailer I purchased from an out-of-state dealer. While driving during stock market hours, I use SiriusXM radio to listen to CNBC and Fox Business, keeping up with the day’s financial news. While I enjoy the information, I find myself realizing how differently my investment recommendations work compared to what the financial media pumps out.

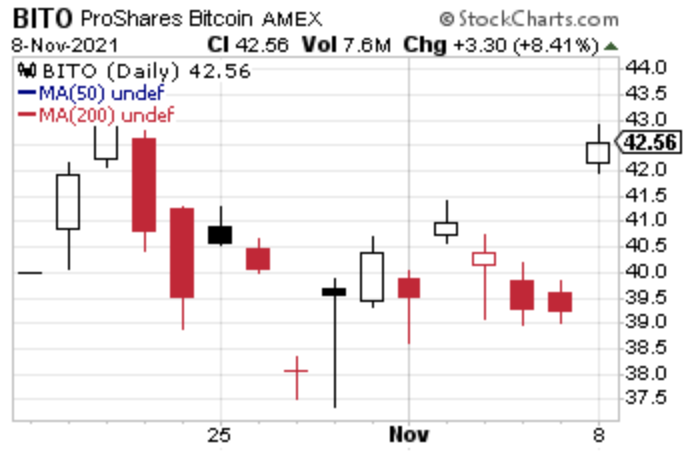

Before I get to the meat of my topic, I have to point out one item that I found to be funny. On October 19, the first Bitcoin tracking ETF, ProShares Bitcoin Strategy ETF (BITO), started trading. At this time, funds are not allowed to own actual Bitcoin as the portfolio assets. Instead, BITO holds Bitcoin futures, which trade on a regulated exchange.

Much of the financial network discussion covered the relative merits of using futures versus actual Bitcoin in the fund’s portfolio and whether the shares will accurately track the changes in Bitcoin. I cracked up when the TV commentators several times referred to “physical” Bitcoin compared to futures contracts. If you could buy a physical Bitcoin, I would! I’ll store it with my physical gold and silver.

Enough of the fun stuff.

What I found interesting about all the stock discussions was the inevitable question of whether investors should buy or sell the stock in question. An investor who regularly tunes in to one of the financial news networks could easily pick up the idea that investing means buying and selling stocks every day.

Network individual stock discussions almost always focus on the short-term: what impending news or events will cause the stock price to go higher or lower? This immediately upcoming information feeds into the buy or sell recommendations.

Two straight days of listening to these networks helped me understand why many investors stay constantly worried about timing the buying and selling in their investment portfolios. They get the mindset that trading is the only way to make money.

Let me suggest that you can do fine in the markets with a third option. Instead of only buying or selling, think about HOLDING. You never hear someone on TV say a stock is a hold. That’s boring. However, long-term holding of the right investments will produce attractive returns and a lot less stress.

That’s exactly what my members and I do with The Dividend Hunter portfolio. To see how you can join and get access to more than 30 high-yield, low-risk dividend stocks, click here.

The truth is, most successful stock market investors buy shares of great companies and hold those shares for years. For example, Main Street Capital (MAIN) has been a Dividend Hunter recommendation since I launched the service in 2014. A buy and hold investment in MAIN starting on July 1, 2014, has returned 12.13% per year, with dividends reinvested. An investment of $10,000 into this conservative business development company in 2014 would now be worth over $23,000.

Currently, I like the idea of buying shares of the Global X Russell 2000 Covered Call ETF (RYLD) and its 11% dividend yield with monthly dividends. With the dividends on automatic reinvest, this fund will generate great returns, as long as the stock market keeps going up. If the market goes through a correction and then recovers (hint: the stock market always recovers), an investment in RYLD would make even more money.

I am convinced that a buy-and-hold approach with high-quality, dividend-paying investments will outperform the portfolio of most of those investors trying to time the market or constantly jumping from stock to stock. Plus going with a long-term strategy that works will be a lot less stressful.

Thousands of people agree, and follow along with my investment approach in The Dividend Hunter. You can join them today, and get access to several special reports, a portfolio of over 30 of my favorite high-yield stocks, and much more. Just click here and get started today!