YieldMax ETFs began offering single-stock covered call exchange-traded funds in November 2022, with Tesla as the underlying stock. These funds use the traditional call option selling strategy to generate income to pay dividends. They turn low-yield, popular stocks into high-yield investments. Currently, YieldMax offers almost 40 ETFs with underlying individual stocks.

On October 30, 2024, Kurv Funds launched six single-stock covered call ETFs. These ETFs typically have lower distribution yields compared to the YieldMax ETFs covering the same stocks.

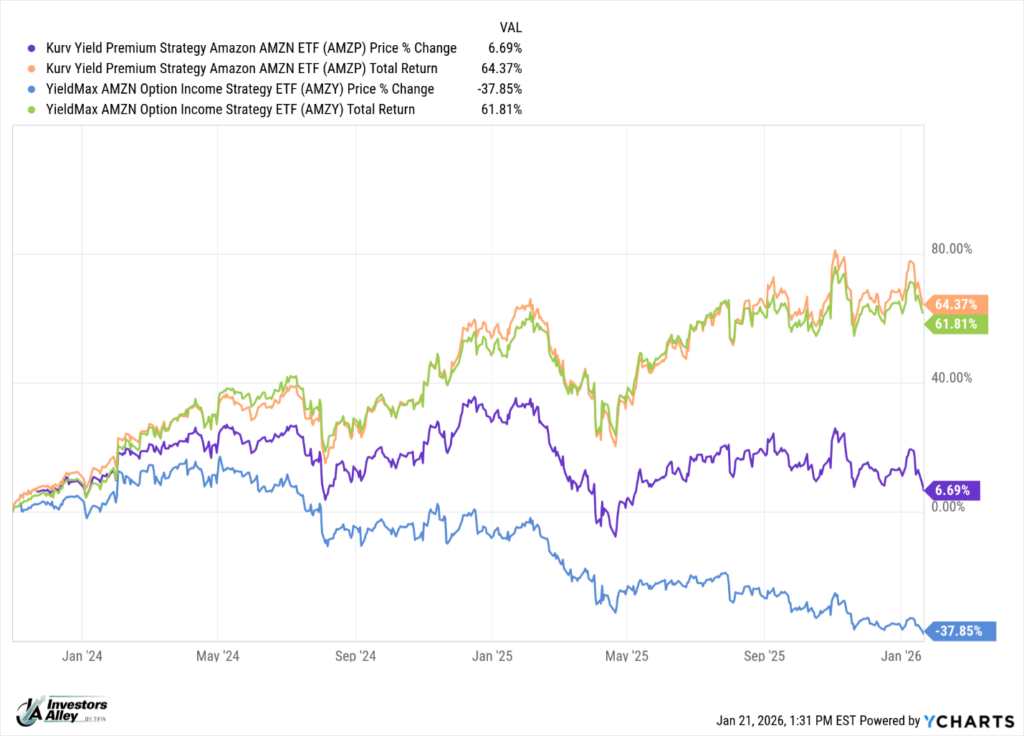

A couple of times a year, I like to compare the funds from YieldMax and Kurv with the same underlying stock. I look at total returns. Let’s look at the two Amazon.com (AMZN).

The YieldMax AMZN Option Income ETF (AMZY) has a current distribution yield of 24.42%.

The Kurv Yield Premium Strategy Amazon (AMZN) ETF (AMZP) has a reported distribution yield of 20.78%.

Yields alone don’t tell the whole story. These ETFs often show share price erosion due to how the option selling is managed. For these ETFs, I look at share price movements and realized total returns. Let’s compare the two ETFs for the time frame since the Kurv funds were launched.

Note that the two ETFs posted similar total returns: 64.37% for AMZP and 61.81% for AMZY. However, AMZP shows a positive share price return, while AMZY saw its share value drop by almost 40%.

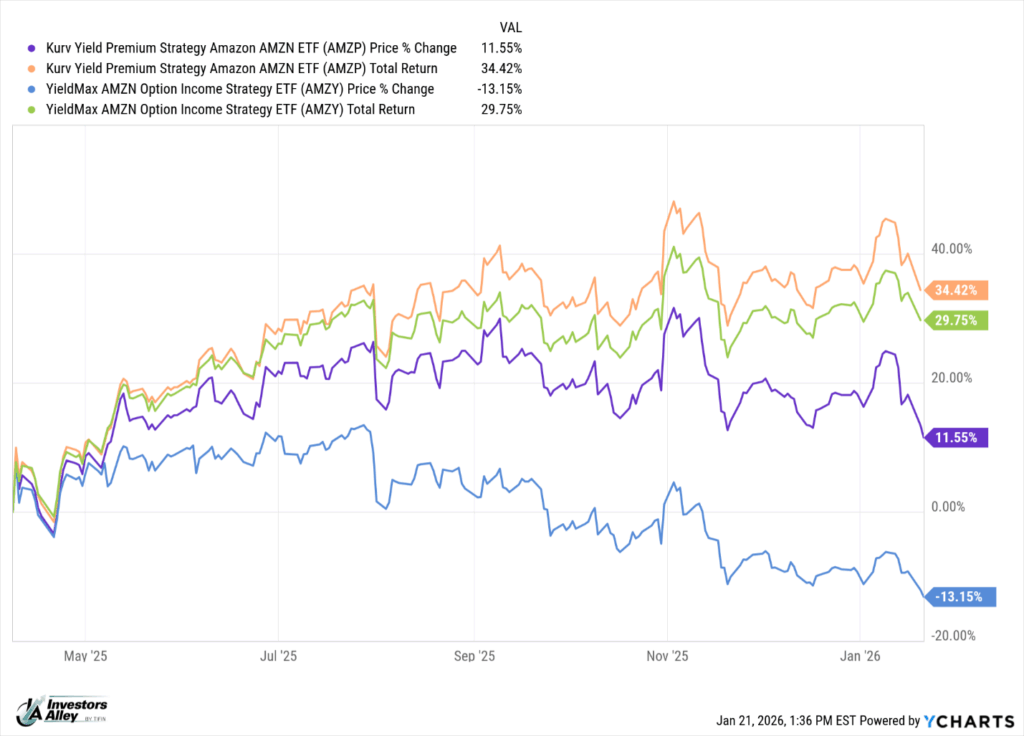

I also like to see how these ETFs performed after the early April bottom-of-the-bear market that hit stocks in the 2025 first quarter:

This time frame again shows slightly better performance for Kurv’s AMZP. The YieldMax AMZY continues to struggle with share price appreciation.

If you are looking for a covered call ETF on Amazon, Kurv’s AMZP is the better choice.

How to double your money over the next 34 months

Tim Plaehn reveals how Trump's Fed takeover could move three assets giving you the chance to double your money over the next 34 months.