There is frustration among numerous management teams of companies with high-dividend yields that the stock market has not credited for continued dividend payments. The result has been stock prices that fell and stayed down, resulting in tremendously high yields on the shares.

I admire the companies that have protected their investors by not cutting dividends; however, they need to do something to bring share values back up to pre-crash levels. There is a growing trend of stock buyback authorizations as a supplement to or instead of restoring cut dividends. It will be interesting to see how this strategy works out.

A share buy-in reduces the total number of shares in the public float. A buyback has two effects. One is that even if the company does not grow net income or cash flow, the profits per share increase because the income gets divided by a smaller number of shares. Also, reducing the share count decreases the amount of cash a company pays out as dividends. These factors make share buybacks potential win/wins for companies that pay attractive dividends.

It is essential to evaluate how a company plans to fund any announced share buyback authorization.The potential pitfall of stock buybacks primarily revolves around where the cash comes from and whether it could be put to better use in other investments. The best course is to buy in shares using free cash flow generated by the business; however, this path often comes with a dividend cut to free up cash flow. Another option is to borrow the money. Consider a company that can borrow at 6% interest and uses the cash to buy back shares yielding 12%.

Finding Stocks Paying 15% with 100% Potential Share Price Gains [ad]

Generally, in this market, I am a fan of the recent buyback announcements. In my investment portfolio, I own the same stocks that I recommend to subscribers of my investment services, including my high-yield service, the Dividend Hunter. There are stocks on my recommendations list that I would love to see appreciate, and I suspect my subscribers would also appreciate (pun intended) any gains.

Here are three stocks with recent buyback announcements, which may or may not be a recommended investment in one of my services.

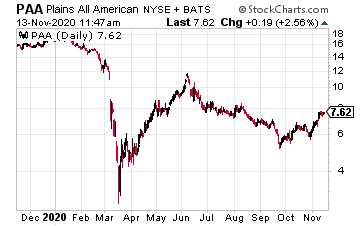

Plains All American Pipeline LP (PAA) just announced a $500 million common equity repurchase program.

Half a billion dollars is a meaningful amount for Plains, with a current $4.8 billion market cap. The company also projects $900 million of free cash flow after distributions for 2021, so they will not go deeper in debt to fund the buyback.

PAA shares currently yield over 10%.

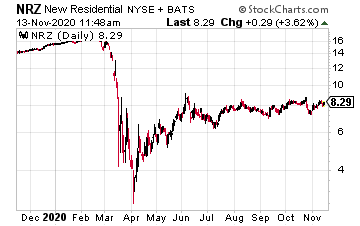

Taking a different approach to buybacks, New Residential Investment (NRZ) announced it would buy-in up to $100 million of the company’s outstanding preferred stock shares.

The A and B series preferreds currently yield 8.5% and are trading about 10% below par.

I recommended my Dividend Hunter readers jump on the New Residential preferred A shares back in the Spring when the sell-off pushed the preferred stock prices down close to $10.00.

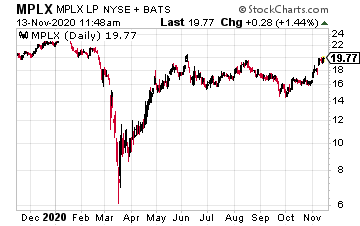

In its 2020 third-quarter earnings report, MPLX LP (MPLX) announced a $1 billion unit repurchase authorization.

MPLX has not reduced its common shares dividend throughout the pandemic, and the shares currently yield almost 15%.

Buying in $1 billion worth reduces the dividend payout by $150 million per year. MPLX has a $20 billion market cap.