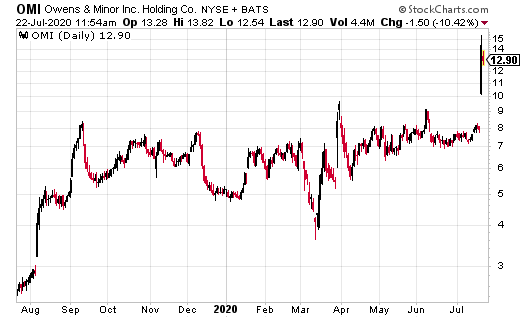

Owens & Minor (OMI) had been flying under Wall Street’s radar until it preannounced earnings this week.

The medical supplies provider told the market it is essentially doubling its previous adjusted net income guidance. OMI raised projections for net income from $0.50 to $0.60 for the year to between $1.00 and $1.20.

OMI said it “expected to benefit from improved productivity and increased manufacturing output in response to unprecedented demand for personal protective equipment, an earlier than expected increase in elective procedures across much of the country, favorable product mix, and operating efficiencies.”

Immediately after the announcement, OMI stock opened higher, moving to just over $10 from a close of just under $8, and then continued to move higher printing above $15.

Related: ABC, MCK, OMI Deliver Growth From the Healthcare Supply Chain

Owens & Minor is a multi-faceted medical supply company providing products, as well as logistic and warehousing services, for a large variety of medical supplies. OMI could also be described as the Costco (COST) of medical supplies, for customers large enough, and with the capacity to accept bulk delivery of medical supplies.

The company has been running at full steam providing personal protective equipment (PPE) in the COVID-19 pandemic. But, the recent preannouncement, which highlighted an earlier than expected return of elective procedures, is good news for Owens & Minor.

An increase in elective procedures will benefit company margins, as they move from lower margin PPE to higher margin medical procedure supplies.

Owens & Minor has also been focused on productivity gains in recent quarters, which may be playing into the increase in earnings.

Here Are the Three Stocks Older Investors Are Using to Save Their Retirement [ad]

The company has stated, “The healthcare industry significantly lags behind other industries in productivity gains. Comparatively, health services have only improved productivity 0.4% where U.S. manufacturing has achieved gains of 3.9%. This gap is widening at the same time as profit pressures increase.”

Owens & Minor is addressing the productivity issue, saying, “it has identified $150 billion of costs that our manufacturers and provider partners face due to complexity and pain points in their supply chain.”

The company is set to release actual earnings on August 4th, after the market closes. A conference call is set for 4:30 pm that day, where Owen & Minor will address the raised guidance.

Steven Adams’s personal position in Owens & Minor: none.