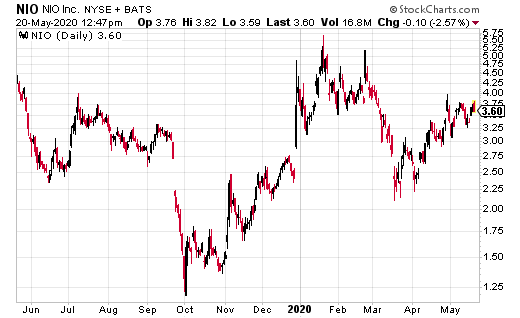

Shares of electric vehicle maker, Nio (NIO) have faced plenty of pressure this year.

Most recently, on news China will cut subsidies on new energy vehicles, such as electric cars by 10% this year. Under China’s new plan, it will also extend subsidies for buying NEVs to 2022, and tax exemptions on purchases for two years.

NIO has also been pressured by news there is substantial doubt in its ability to continue as a going concern, said the company in March 2020. “Its cash balance of $151.7 million as of Dec. 31 is not adequate to provide the required working capital and liquidity for continuous operation in the next 12 months,” the company said, as noted by Reuters at the time.

However, NIO is seeing some signs of improvement.

In recent days, the company posted April 2020 delivery numbers that were better than expected. In fact, deliveries were up to 3,155 for the month, a growth rate of 181% year over year, and 106% month over month.

And, according to Chairman and CEO, William Bin Li, “In April, we achieved record-high monthly ES6 deliveries since June 2019, and deliveries of the all-new ES8 had also been well on track. These results were mainly contributed by the recovering production and delivery capabilities. Meanwhile, we have witnessed strong order growth momentum driven by the increasing recognition of our competitive products, exceptional services, and particularly the battery swapping technologies by our existing and potential users.”

Steven Feng, chief financial officer of NIO also added, “As we continue to expand our sales network through the launch of more efficient NIO Spaces, we now have 105 points of sales in operation in China, promoting our brand and products to a growing number of regions and communities. Additionally, with the positive order and delivery momentum, we remain committed to further improving our gross margin and operational efficiency.”

While that’s encouraging to hear, the company is also still burning through cash than it can generate through operations.

Ian Cooper’s Personal Position in NIO: None