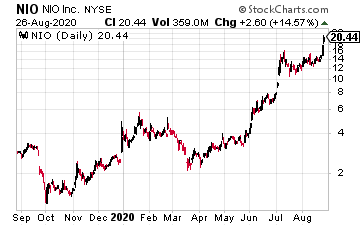

Shares of Nio Inc. (NIO) are still exploding higher, last trading at $18.87. This week, UBS analyst Paul Gong upgraded the stock to the equivalent of a Hold from a Sell.

The analyst also raised his price target from $1 to $16, according to Barron’s. Strong sales are also sending the stock higher. For July 2020, the company quadrupled its EV sales. Sales were up 322% to 3,533 vehicles – its second best month ever.

For June 2020, the company sold 3,740 EVs for the month, up 179% year over year. “In June, we achieved a historical high of monthly deliveries, contributing to our best quarterly performance. We appreciate the continuous support from our growing and loyal user community,” William Bin Li, Nio’s chairman and CEO, said.

BigCommerce Holdings Inc. (BIGC) was up more than $31 this week after announcing the availability of checkout on Instagram for eligible US merchants. BigCommerce merchants can be among the first to adopt the new feature, which provides shoppers a secure way to purchase products they discover on Instagram in a few clicks, without leaving the app, according to a press release.

Have You Downloaded Your Copy of the “Beginner’s Options Guide? [ad]

“Leveraging BigCommerce’s native integration with Facebook Commerce Manager, merchants can easily connect their ecommerce storefront’s catalog to Instagram and give customers the ability to buy from their favorite brands directly on Instagram—rather than navigating to a brand’s website to make a purchase—and pay using PayPal, Visa, Mastercard, American Express or Discover. After placing an order, customers can also use the Instagram app to view their order status, estimated delivery date and tracking number, as well as cancel orders, initiate returns or request additional support.”

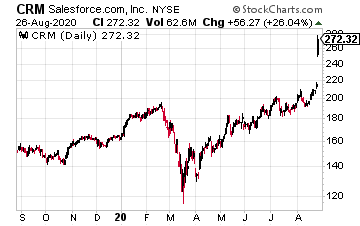

Salesforce.com Inc. (CRM) was up about $40 a share after announcing fiscal second quarter results. “It’s humbling to have had one of the best quarters in Salesforce’s history against the backdrop of multiple crises seriously affecting our communities around the world,” said Marc Benioff, Chair and CEO of Salesforce. “Salesforce was founded on our belief in stakeholder capitalism and our core values of trust, customer success, innovation and equality.”

“Our success in the quarter brought all of this together with the power of our Customer 360 platform, the resilience of our business model, putting our customers first and doing our part to take care of all of our stakeholders. We know that together we have an opportunity to emerge from these times even stronger.” Salesforce delivered the following results for its fiscal second quarter – Total second quarter revenue was $5.15 billion, an increase of 29% year-over-year, and 29% in constant currency. Subscription and support revenues for the quarter were $4.84 billion, an increase of 29% year-over-year. Professional services and other revenues for the quarter were $0.31 billion, an increase of 23% year-over-year.”

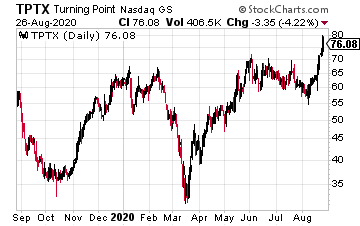

Turning Point Therapeutics (TPTX) Jumped nearly $7 after the Food and Drug Administration (FDA) granted a third Fast-Track designation to its lead drug candidate, repotrectinib.

The designation was granted for the treatment of patients with advanced solid tumors that have an NTRK gene fusion who have progressed following treatment with at least one prior line of chemotherapy and one or two prior TRK tyrosine kinase inhibitors (TKIs) and have no satisfactory alternative treatments.

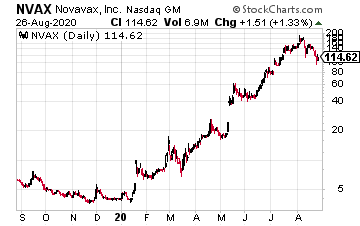

Novavax Inc. (NVAX) plunged after reporting mixed second quarter results. However, we could see a reversal with the company commencing Phase 2 trials in Australia and the U.S. Insiders have also been cashing in on the stock’s latest move higher, which isn’t necessarily a negative sign of potential further weakness.

At time of this writing, Ian Cooper does not hold a position in any of the stocks mentioned.