This article could save you a lot of money…

Because one of the biggest mistakes options traders make is trading the wrong stock at the wrong time.

If you’ve run into this problem, you know how frustrating it can be.

To have all the stars aligned for a winning trade… only to discover one crucial piece missing.

I’ve seen it time and time again.

Soon you could find yourself trying to force a trade when there isn’t one…

And that’s what gets beginners and advanced traders alike in a lot of trouble.

That’s why in this article, I will show you how to pick the best stocks for selling covered calls…

Let’s start with the most critical step:

Picking a good stock for covered calls.

As you know, you can sell a covered call using the stocks you already own.

I think that’s excellent news, especially if you’re a beginner trader, because I’m confident your long-term holdings are good companies.

Of course, there’s always the chance that your biggest long-term holding is in a ‘meme’ stock like Bed Bath & Beyond…

And in that case, you should probably consider owning a more reliable company like Amazon.

That’s because a stock that’s considered safe by most buy-and-hold analysts typically means it can work well for covered calls.

You can even sell covered calls on a low-cost passive index fund.

Depending on which way your trade moves…

You could be left holding the stock after the expiration date.

That’s why owning GOOD stocks that you wouldn’t mind holding for months or years is a great way to enjoy covered calls with less risk.

When you’re selling covered calls on stocks you love to hold regardless, you can win in nearly every scenario…

Think about it. You can collect income either way, but in one common scenario, you could be left with your initial shares!

And this is when a lower-priced stock like Amazon also helps out.

Why cheaper often = better

If you recall…

On July 6, 2022, Amazon was trading for more than $2,000 per share.

That means you’d need at least $200,000 invested in Amazon alone to be able to squeeze income out of the stock!

That’s way out of most of our leagues.

But when Amazon decided to make a 20-for-1 stock split on June 6, that all changed.

Now you need only one-twentieth of that – 20% – to be able to trade covered calls on them and generate income from your shares month after month.

And when a stock is affordable, you can take advantage of what’s happening in the markets quicker for more chances to collect income.

For example — I recently revealed my #1 stock for 2022 here…

One of the main reasons it won out to become my new favorite is how affordable the share prices are right now.

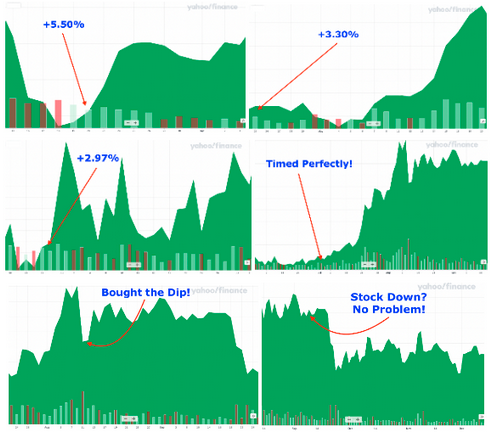

So when I spotted six winning trades in a row on this stock, it was easy for anyone to join in without putting too much money at risk:

But that comes down to more than just the stock price.

Here’s what you should consider next:

You have a good stock. Now what?

The next thing to look at is the premium available for the stock.

In other words:

How much are people willing to pay you for the right to your shares?

Remember, whatever happens, the seller gets to keep that premium.

If things go well, that’s all that happens – the seller gets some cash and gets to keep his shares.

At worst, the seller gets to keep his premium and sells his shares to the buyer for even more money.

The stock’s implied volatility is a good chart to look at when you’re considering the available premiums.

How to find your stock’s implied volatility: My go-to service is Market Chameleon, but unfortunately, their implied volatility data is only for paying users. A couple of free alternatives you can use are BarChart and Volafy. Your broker should also have this data in their ‘options’ tab.

For example, if most investors believe a stock is riskier than its asking price — you could have a good covered call trade opportunity.

Consider all this before placing your next covered calls trade, and you could soon have yourself a winning formula…

You choose whether you want to focus on the cash flow aspect, the upside potential, or make the trade more defensive in nature…

You can do all that with covered calls!

That’s why I made this strategy the cornerstone of The ONE Trade Retirement Plan I recently unveiled — click here for the full details.