To help, the Federal Reserve cut interest rates to zero, and announced a massive $700 billion bond buying program. Unfortunately, it may not have been enough. “The Fed is trying to be preemptive to calm the markets, but what’s worrisome to me is that they’ve unloaded the gun and there are no bullets left. If the markets don’t react calmly to this, they’re going to take it as a sign of fear and desperation,” says Nick Giacoumakis, president of New England Investment & Retirement Group, as quoted by USA Today.

Today, just minutes into the trading day, the S&P 500 was down 252 points on the day after triggering the “circuit breakers” earlier. Should it lose 560 points on the day, markets will be halted for the day. All in an effort to prevent markets from falling through the floor.

However, even in times of panic, there is opportunity, especially as the Volatility Index (VIX) explodes to highs we haven’t seen since the subprime crisis of 2008. With the VIX likely to push to higher highs, investors have been seeking opportunity in VIX-based ETFs and ETNs.

Some of the top ones include:

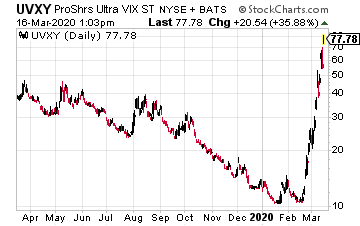

ProShares Ultra VIX Short-Term Futures ETF (UVXY) – This ETF was designed to match two times (2x) the daily performance of the S&P 500 VIX Short-Term Futures Index. Since the start of 2020, the UVXY has exploded from a low of $10.44 to $80.81.

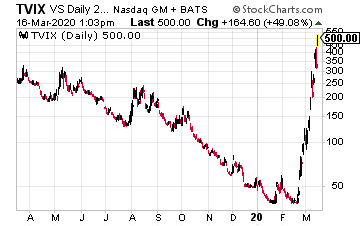

Velocity Shares Daily 2x VIX Short-Term ETN (TVIX) – This ETF tracks an index of futures contracts on the S&P 500 VIX Short-Term Futures Index. Since the start of the year, this ETF has run from a low of $40.06 to a recent high of $495.

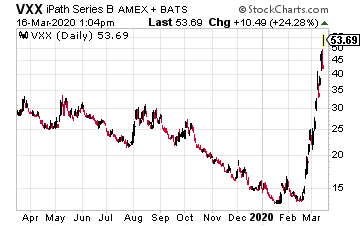

iPath S&P 500 VIX Short-Term Futures (VXX) – The VXX exchange traded note (ETN) provides exposure to the S&P 500 VIX Short-Term Futures Index Total Return. Since the start of the year, the VXX has soared from a low of $13.15 to a high of $53.64.

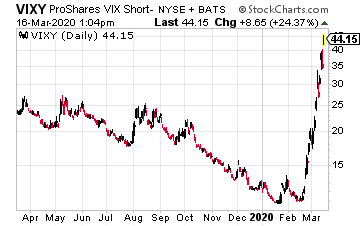

Pro Shares VIX Short-Term Futures ETF (VIXY) – This ETF provides long exposure to the S&P 500 VIX Short-Term Futures Index, which measures the returns of a portfolio of monthly VIX futures contracts with a weighted average of one month to expiration. Since the start of the year, the VIXY has jumped from a low of $10.80 to nearly $46.

As of this writing, Ian Cooper does not have a position in shares of UVXY, TVIX, VXX, or VIXY.