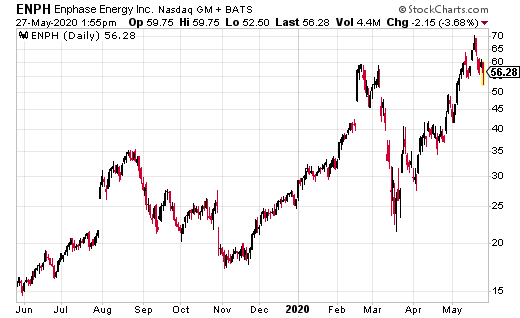

Enphase Energy (ENPH) has been incredibly explosive.

Since hitting a low of $21.49 in March 2020, ENPH has rallied to $58.44. Not only did it report impressive earnings, but it also just announced a collaboration with the University of Washington for a 100% renewables grid.

According to ENPH’s latest press release, “Under the heading, A Scalable Control Architecture for 100% PV Penetration with Grid Forming Inverters, Enphase joins a team of industry partners and experts from the University of Washington to help solve one of the most important challenges to the proliferation of grid-attached distributed energy generation.”

“Enphase will focus on running specialized test scenarios and gathering data at the Company’s single- and three-phase, on- and off-grid rooftop solar R&D facility in Austin, Texas. The test array is equipped with Enphase microinverters featuring the Company’s custom ASIC, which powers the software-defined architecture that allows Enphase to reprogram a test fleet of microinverters with control architectures and algorithms developed by the University of Washington. The control architectures and algorithms will be tested to validate robust controller performance under real-world weather variability.”

“We are pleased to report revenue of $205.5 million in the first quarter of 2020, along with an all-time record for gross margin, despite COVID-19. Our first quarter revenue increased 105% year-over-year. We shipped approximately 643 megawatts DC, or 2,012,476 microinverters, as our worldwide teams did an excellent job of ensuring product availability and on-time customer deliveries,” reported President and CEO Badri Kothandaraman.

Some of the key highlights from earnings included:

- Cash flow from operations of $39.2 million; ending cash balance of $593.8 million

- GAAP gross margin of 39.2%; non-GAAP gross margin of 39.5%

- GAAP operating expenses of $36.0 million; non-GAAP operating expenses of $28.5 million; and GAAP operating income of $44.7 million; non-GAAP operating income of $52.8 million

Ian Cooper’s Personal Position in ENPH: None