Last year, investors and savers rushed to buy Series I savings bonds as their inflation-linked yields approached 10%. Now, the yield on I bonds is much, much lower. If you purchased these bonds for the high yield last year, it may be time to cash them in and invest elsewhere. Let me explain why – […]

Bonds

Why An Inverted Yield Curve Should Be the Least of Investors’ Worries

In the past year and a half or so, there’s been lots of talk about the U.S. yield curve essentially inverting. So today, I wanted to make a couple of important points about it that’s important for you to see. As you know, the yield curve visually depicts how bond maturity dates and interest rates […]

The 2023 Bond Market Winner: Emerging Markets

There has been an unexpected winner in the bond market in 2023: emerging market bonds. This is especially true for emerging market bonds priced in local currencies. Currently, the gap in government borrowing costs between emerging markets and U.S. Treasuries is at its best level since 2000. The reason is that investors are pricing in […]

Don’t Be Fooled by the “High” Yield on T-Bills Right Now

I hear a lot of financial advisors (on the financial news networks) discussing how their clients like Treasury bills at current yields. The idea is that investors can safely invest in T-bills and avoid the next stock market crash. I have some thoughts on this investment tactic, because this is not nearly as good an […]

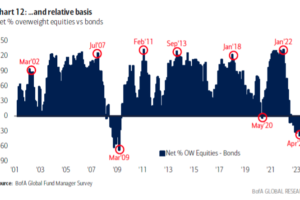

Even the Pros Get Market Timing Wrong

Even with professional investors, herd mentality makes successful investing a daunting task. This year, as you see prediction after prediction about a market decline, stocks have confounded the experts with solid gains. My Dividend Hunter strategy shows investors how to not fall into the “buy high, sell low” wealth destruction cycle. Last week, one of […]

If You’re Worried About Banks, Invest Here Instead

During the current period of intense market volatility, some investors have grown fearful. For these concerned investors, municipal bonds, aka “munis,” are worth a look. Munis are issued by state and local governments, and generally pay tax-exempt interest at the federal and potentially state levels. Municipal bonds have played a vital role in building the […]

There Will Be No “Next” Bank Collapse

It got bumpy out there all of a sudden. Although I was surprised that Silicon Valley Bancorp (SIVB) lit the fuse, I am not shocked that something blew up. Every time the Federal Reserve has a rate increase cycle, something blows up. Signature Bank (SBNY) and Silvergate, on the other hand, were not that much […]

Forget Bonds, Buy Unilever

Unilever plc (UL) is a leading international consumer goods company, and one of the largest providers of personal care products. Some of its well-known leading brands include Dove, Lifebuoy, Hellman’s, Knorr, Axe, and Magnum. Because of the business it’s in—consumer staples—Unilever’s stock is often thought of as a “bond proxy.” This status helped propel its […]

Why Bonds Will Be Among the Biggest Winners of 2023

Along with a bear market for stocks, 2022 has, according to Morningstar, been the worst year ever for the bond market. Bond values have fallen up to 30% this year, putting a bigger dent in many retirement accounts that hold bond ETFs. Fortunately, in the current, higher interest rate world, you can invest safely in […]

Get a Government-Backed 9.62% with This Investment

With the stock market tumbling, investors are on the hunt for safer investments that pay attractive returns. The fact that you can earn 9.62% from a U.S. Savings Bond is getting a lot of buzz. Today, let’s review the features, pros, and cons of investing in these Series I Savings Bonds. The U.S. government sells […]