The Biden administration recently indicated they want 50% of all vehicle sales by 2030 to be zero-emission—i.e., electric cars. While I am skeptical that Americans will be willing to buy that many electric vehicles, my thoughts today concern what companies will profit from the electrification of the U.S. vehicle fleet. And it’s worth noting that I don’t believe the manufacturers of electric vehicles will be the biggest winners.

First, I think it currently is impossible (outside of Tesla, with its giant headstart) to pick out even a handful of winners from amongst the large number of new electric car companies. The website Energy Startups has a list of the Top 76 Electric Cars startups. Think about that number compared to the current number of established car companies, which are also going big time into EVs and hybrid vehicles—this is why I think betting on electric vehicle stocks will most turn out to be bad bets.

Up next, we have charging stations. Currently, there are 150,000 gas stations in the U.S., each with six to eight pumps per station— let’s call it one million fuel pumps in all. Because electric cars take three times as long to “refuel” as it takes to gas up my big SUV, I expect the U.S. will need a similar seven-figure number of charging stations. Currently, according to the U.S. Department of Energy, there are 41,400 charging stations in the U.S.; fewer than 5,000 of those are fast chargers. It is likely that if the required number of stations are built, the federal government (we taxpayers) will foot the bill. A startup like ChargePoint Holdings (CHPT) may be a winner if we want to invest in this space; however, there is not much new technology in charging stations, and mega large construction companies like Bechtel and Kiewit (both privately held) may therefore end up with the bulk of the charging station construction business.

I believe the best use of an EV comes from an owner who commutes each day and can charge the car at home overnight. Letting your car charge up while you sleep makes more sense than driving 200 miles and then sitting around for an hour before you can continue on a trip. The cost per kilowatt-hour for residential services will be less than half what drivers pay at a charging station “pump.” Still, an EV owner who commutes to work every day and charges the car each night will see his or her power bill increase by up to a couple of hundred dollars each month.

These facts add up to the theory that the “locked-in” winners of the EV car push will be the electric power utility companies. The utilities will get the federal government to pay for the needed infrastructure, and their residential customers will be paying much larger monthly bills.

I know utilities are boring. But, they pay attractive and growing dividends. Steady growth in EV sales will let utilities grow profits faster and increase the rate of dividend growth. If utility stocks produce low-teens compound annual total returns between now and 2030, an investment in this sector will triple by the end of the decade.

Here are a couple of funds that let you invest in the build-out and power sales to be boosted by a push for more EVs on the road.

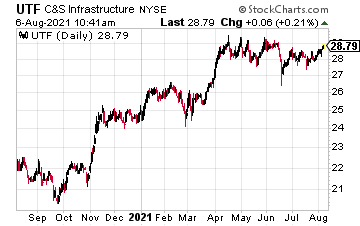

The Cohen & Steers Infrastructure Fund (UTF) is a closed-end fund that pays monthly dividends and currently yields 6.5%.

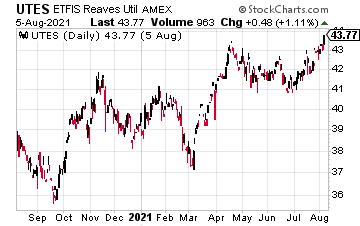

The Virtus Reaves Utilities ETF (UTES) is an actively managed, utility sector-focused ETF. The folks at Reaves Asset Management are the very best at analyzing companies in the sector.