I spend my day reading financial news, and usually I have my TV tuned to one of the business networks in the background. I have been in and around the financial world formore than 30 years. I wake every day and tell myself: “We live in very interesting times.” One of the things making them so interesting is trying to ferret out whether the laws of economics, as I learned them, still apply.

When investing or trading, the big dilemma comes from the challenge of what you think/believe should happen in the markets versus where the markets actually go. Just because you have a strong belief, either from study or from hope, and your investments make money, that does not mean your expectations will come true.

To be successful, investors must be ready to adjust their beliefs and expectations based on what the markets give them. Here are some examples.

By many historical yardsticks, the U.S. stock market could be viewed as highly overvalued and due for a correction, or even an actual bear market. A lot of my subscribers write about their expectations for a coming stock market pullback. But even though there are plenty of signals that would seem to support their beliefs, the stock market may continue to go up for months and months. The biggest positive for stocks is that they are one of the two only games in town for investors.

History shows us that pumping trillions of new money (okay, never before has it been trillions of dollars) into the economy should lead to inflation and higher interest rates. I just saw this note from interest rate expert Mark Grant: “Spain just issued 30-year bonds at 118 basis points lower than the markets will lend to the U.S. Treasury.” Spain should not be able to borrow for less than the U.S. government. I am concerned that the financial markets will not be able to absorb all the U.S. government’s new debt, which will quickly push interest rates higher.

On the other side, the Federal Reserve will do everything it can to keep down rates. Who will win: the Fed with its near-infinite power, or the markets, which also have near-infinite power?

Someone tell me how electric vehicle manufacturers, with 2% of the U.S. vehicle market, are worth so much more than the traditional vehicle companies that sell the other 98%.

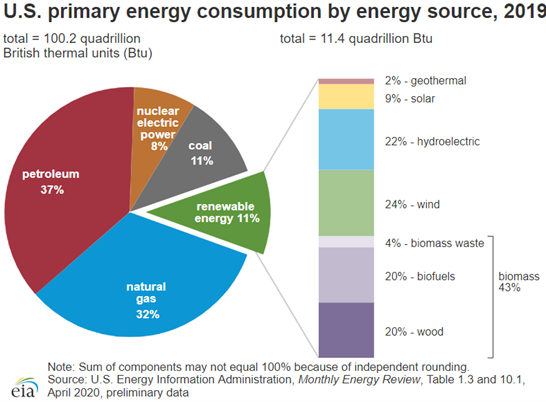

Ditto with renewable energy. For the past two decades, the U.S. has spent massively on solar and wind generation projects. After all that time and money, wind and solar still account for less than 4% of the energy consumed in the U.S.

Finally, I would love to have someone tell me how cryptocurrency is not the biggest trillion-dollar scam in history. In my view, the belief in the bitcoin and its clones are actual signs of mass hysteria. It may be a bubble similar to the Holland tulip mania of the 1600s. At the peak of that event, a single tulip bulb was worth up to $750,000 in today’s money. Within three years, the price was back down to what you think a flower bulb should be worth—a couple of bucks at most. I found this quote from Investopedia to be of interest:

By the end of the year 1637, [tulip] prices began to fall and never looked back. A large part of this rapid decline was driven by the fact that people had purchased bulbs on credit, hoping to repay their loans when they sold their bulbs for a profit. But once prices started their decline, holders were forced to liquidate—to sell their bulbs at any price and to declare bankruptcy in the process. Hundreds who, a few months previously had begun to doubt that there was such a thing as poverty in the land, suddenly found themselves the possessors of a few bulbs, which nobody would buy…

If you are a bitcoin believer, I guess you can take the tulip lesson as a sign to sell when it hits $750,000.

I will confess, I am a value investor with a focus on dividend income. I like companies that make a lot of money and pay out a portion of those profits as dividends. Sometimes the approach feels old-fashioned, but I suspect it will feel less so when one of the bubbles mentioned above goes pop.