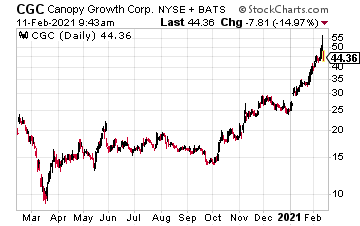

Cannabis stocks, like Canopy Growth (CGC) have been explosive.

As we near a potential push for legalization at the federal level, and as Virginia passes cannabis legislation, related stocks could push to new highs.

Helping, Canopy Growth says it expects to see a profit by the second half of 2022. “We are building a track record of winning in our core markets, while also accelerating our U.S. growth strategy with the momentum building behind the promising cannabis reform in the U.S.,” said Canopy Growth CEO David Klein said, as quoted by CNBC.

The company also said its third quarter revenue was up 23% year over year to $120 million. All thanks to sales of recreational products in Canada, and medical cannabis internationally. However, its loss did widen to $653 million, but it’s trying to improve profitability by cutting its costs and controlling expenses.

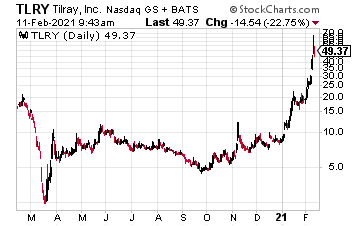

Also soaring on the cannabis boom is Tilray Inc. (TLRY).

Not only is TLRY pushing higher on the above-mentioned cannabis catalysts, it just struck a deal to export medical marijuana to the UK.

Sascha Mielcarek, Managing Director of Tilray Europe, said, as quoted by a company press release, “As demand continues to ramp up in the UK, Tilray is well-positioned to be a leading supplier of medical cannabis products. Regulations are progressing as more and more countries across Europe are recognizing the benefits of medical cannabis and its potential to improve patients’ quality of life. We’re pleased to reaffirm our commitment to delivering medical cannabis to patients in the UK and look forward to offering a variety of GMP-certified, pharmaceutical-grade products in the coming months.”

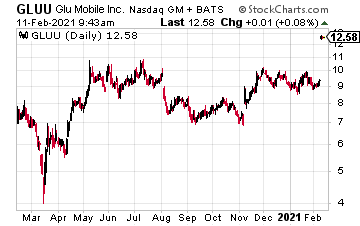

Glu Mobile (GLUU) is being acquired by Electronic Arts (EA) in a $2.1 billion deal.

“The acquisition will immediately add significant scale to Electronic Arts’ mobile games business. The combination of Electronic Arts and Glu creates a leading mobile product portfolio that includes more than 15 top live services across fast-growing genres with a combined $1.32 billion in bookings over the last twelve months.”

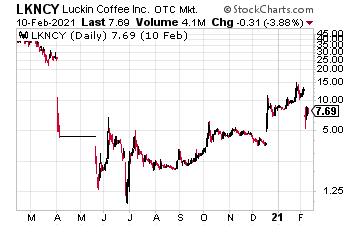

Luckin Coffee (LKNCY) just filed for bankruptcy in the U.S. The company has said the move will help it financially restructure itself and help strengthen its balance sheet in a Chapter 15 filing. The good news for the company is that it won’t materially impact its day to day operations or its open cafes.

As noted by Barron’s, “There are still stores. But the company’s management is new. Luckin’ hasn’t filed financial statements in a long time, and no more analysts follow the stock. There is almost no way for any typical U.S. investor to know what is going on. That’s not a recipe for investment success. Quo Vadis Capital, an independent registered investment advisor, said in a Friday report that the stock is likely going to zero.”

As of this writing, Ian Cooper did not hold a position in any of the stocks mentioned.