Investors were getting excellent returns from SFL Corp (SFL) from the end of 2020 through May 2024. Starting at that time, the shipping stock share values tumbled, and SFL followed suit. Then a dividend cut caused further price erosion. Can this stock turn things around for 2026?

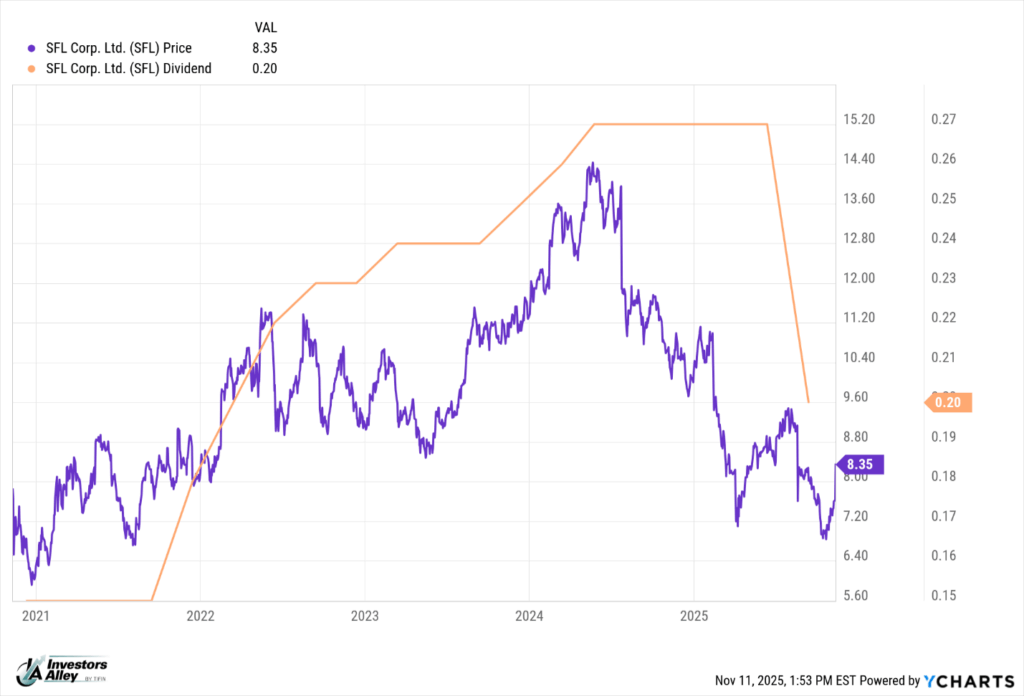

Here is the five-year SFL stock price chart with the dividend rates shown in orange:

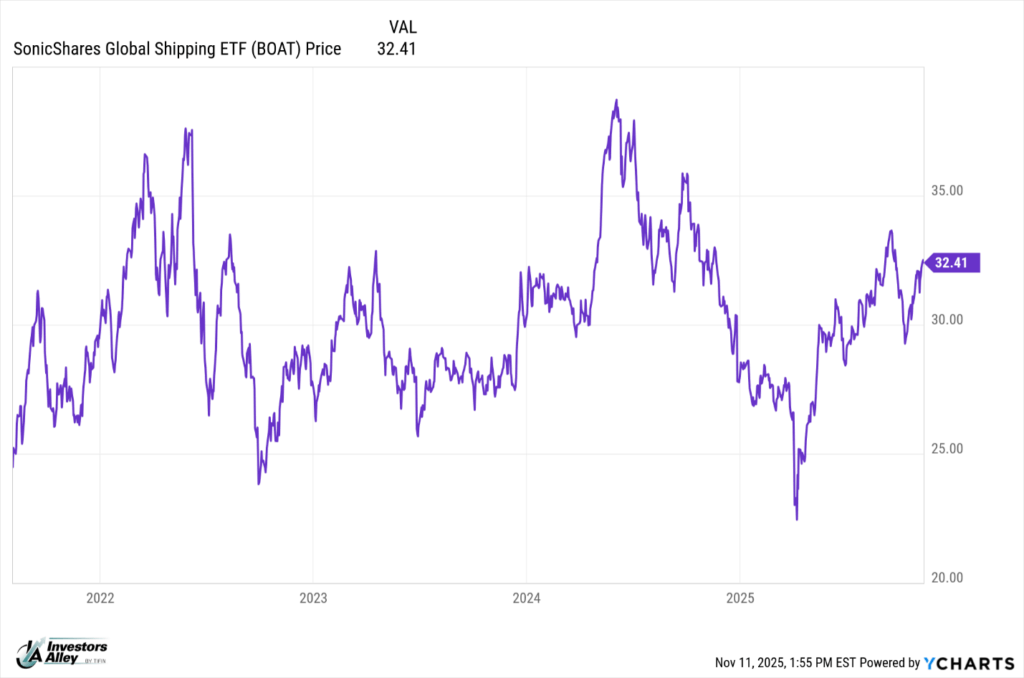

Here is the five-year chart for the SonicShares Global Shipping ETF (BOAT):

You can see that while SFL’s decline from May 2024 matched the broader shipping sector, the dividend cut in August 2025 prevented the stock from participating in the sector rally that began in April 2025.

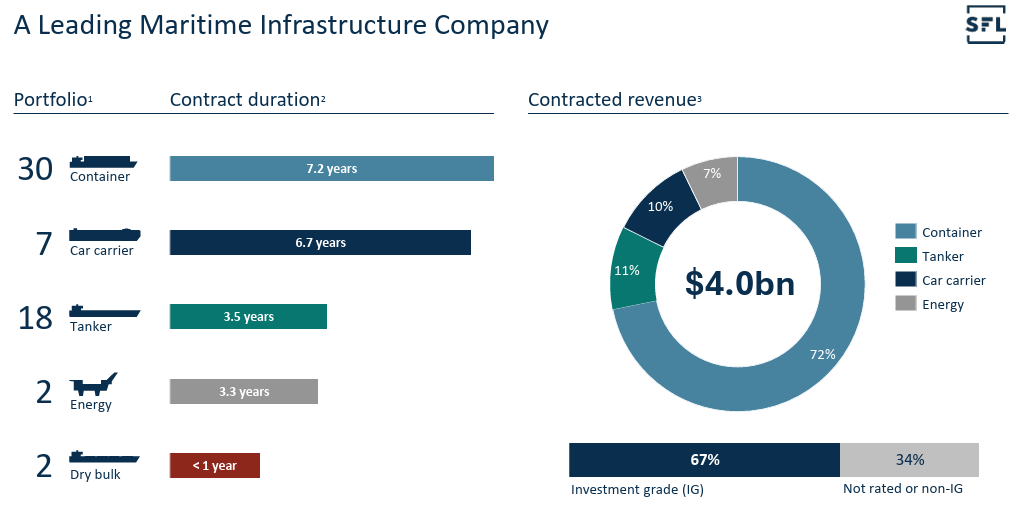

SFL owns a diverse fleet of vessels that it leases on long-term contracts. The company generates revenue $700 to $800 million per year. The billion dollars of contracted revenue means revenue and income will be stable for years.

In August, SFL again cut its quarterly dividend, from $0.27 to $0.20 per share. The reason is that one of the jack-up energy rigs has come off contract and is no longer leased. Those rigs earn up to $600,000 per day; therefore, with one going unleased, the SLF Board elected to take the safe route and reduce the dividend.

Despite the cut, at the current stock price of approximately $8.40, SFL offers an attractive investment opportunity. The current dividend rate yields almost 10%. And when the idle jack-up rig secures a contract, the company will likely increase its payout and the stock price will rise.

The Gold Income Opportunity No One's Telling You About

While investors chase headlines, one overlooked fund is quietly delivering up to $1,152/month. Click here to see the gold income breakthrough most investors are missing.