The latest move by ETF fund sponsors is the launch of funds that leverage the underlying assets and also employ an option-selling strategy to generate income for distributions. Single stock leveraged ETFs and covered call high-yield ETFs have been separate worlds.

For the two types of ETFs, an investor can determine how one would perform during different market conditions. When an ETF combines leverage with option-driven income strategies, it becomes much harder to determine how the fund will perform.

Which brings us to the Defiance Leveraged Long + Income Ethereum ETF (ETHI). This ETF is relatively new, having launched into the market on September 17.

Here is how the Defiance website describes the fund’s strategy:

- Leveraged Exposure: ETHI seeks to deliver approximately 150% to 200% of the daily performance of U.S.-listed ETPs tied to ether, capitalizing on ETH’s volatility and growth potential.

- Weekly Income Generation: By utilizing a credit call spread strategy, the ETF seeks to generate weekly income, providing regular cash flow and a potential buffer against declines.

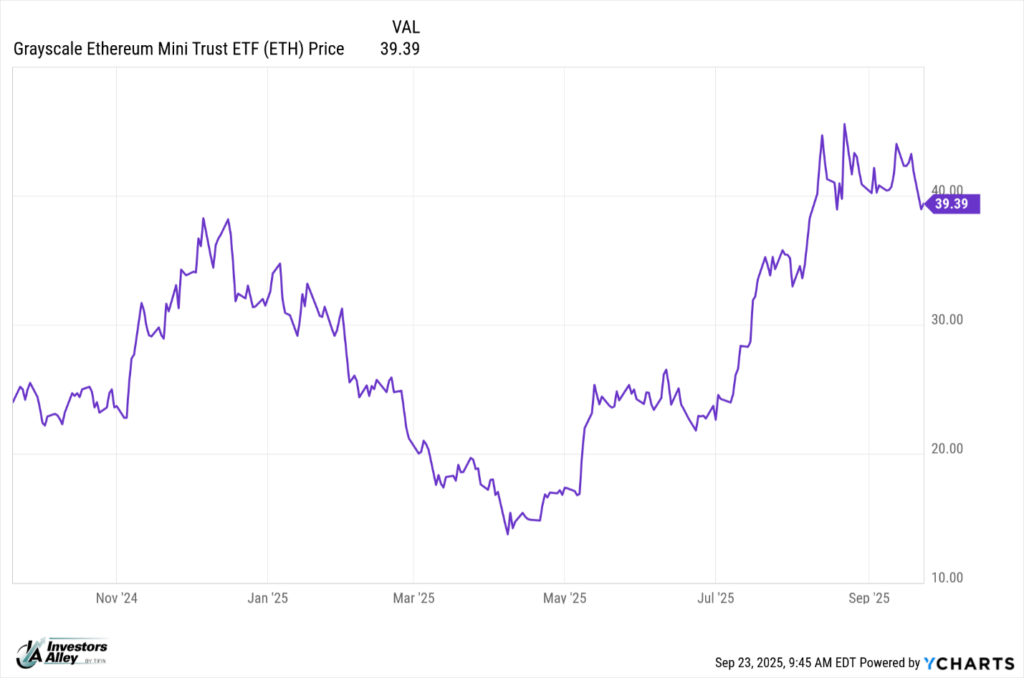

Ethereum, the cryptocurrency, has exhibited significant volatility over the past year. The GrayScale Ethereum Mini Trust ETF (ETH) has 52-week lows and highs of $13.69 and $45.79.

On the option-selling side, the Roundhill Ether Covered Call Strategy ETF (YETH) has sported distribution yields in the 60% to 80% range.

The returns from ETHI will likely be extreme in either direction. A few days after the ETF’s launch, on September 22, cryptocurrencies experienced a steep sell-off. ETH dropped by 7% that day, and ETHI lost 13%. That’s a pretty uncomfortable number for a one-day decline.

I plan to give ETHI some time to show what it can do, whether good or bad.

If you are interested in high-yield, option strategy ETFs, our ETF Income Edge is a must-have subscription. We review and compare the approximately 150 high-yield ETFs to identify those that will deliver high distribution yields as actual returns to investors. We currently have 14 outstanding ETFs in our recommended portfolio.

Expires Tomorrow: Instant Weekly Dividends

Regular investors are quietly securing weekly dividends—from ONE new investment. But you must act fast. After tomorrow’s market close, this income could vanish forever.