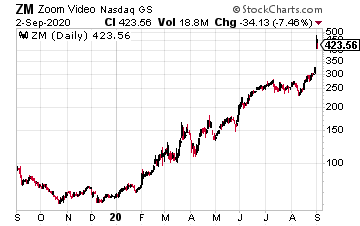

Shares of Zoom Video Communications (ZM) exploded from $317 to a high of $462.80 on earnings. ZM Revenue soared 355% to $663.5 million, topping analyst expectations for $500.5 million. Adjusted EPS came in at 92 cents, which was more than double expectations for 45 cents. ZM also raised its guidance for the full 2021 fiscal year.

Revenue for ZM is now expected to fall in a range of $2.37 billion and $2.39 billion, which, according to CNBC, implies 282% growth in the middle of the range. That’s also above estimates for sales of $1.81 billion.

“Organizations are shifting from addressing their immediate business continuity needs to supporting a future of working anywhere, learning anywhere, and connecting anywhere on Zoom’s video-first platform. At Zoom, we strive to deliver a world-class, frictionless, and secure communication experience for our customers across locations, devices, and use cases,” said Zoom founder and CEO, Eric S. Yuan. “Our ability to keep people around the world connected, coupled with our strong execution, led to revenue growth of 355% year-over-year in Q2 and enabled us to increase our revenue outlook to approximately $2.37 billion to $2.39 billion for FY21, or 281% to 284% increase year-over-year.”

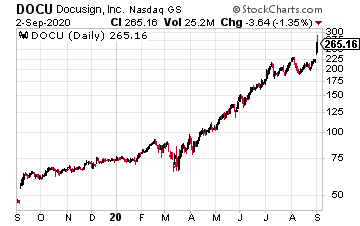

DocuSign Inc. (DOCU) soared to $289 this week after Zoom Video Communications’ earnings report. “Zoom’s earnings, which topped expectations, suggested that technologies enabling remote business functions are still seeing explosive growth due to the pandemic. DocuSign, which enables electronic signatures on legal documents, is due to report its own results after Thursday’s closing bell,” noted MarketWatch.

These Are the 3 Stocks Income Investors Buy and Never Sell. Ever. [ad]

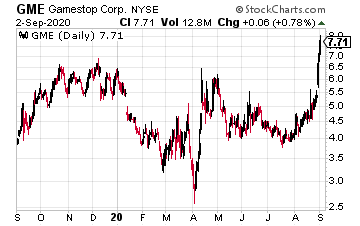

Shares of GameStop Corp. (GME) are higher on news RC Ventures increased its stake in the gaming retailer. According to an SEC filing, RC Ventures, which is run by Chewy co-founder Ryan Cohen now has a 9.6% stake in GME with nearly 6.2 million shares.

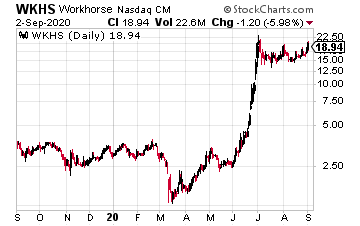

Workhorse Group (WKHS) is pushing higher, too. Not only did it recently enter into a deal with Ryder, it’s now in a strategic agreement with Hitachi. “With Hitachi’s innovation and invaluable expertise in EV technology, smart factory automation and digital technologies, Workhorse is primed to build on our early leadership position as the only last-mile EV distributor selling vehicles for commercial use across the country,” as noted by CEO Duane Hughes.

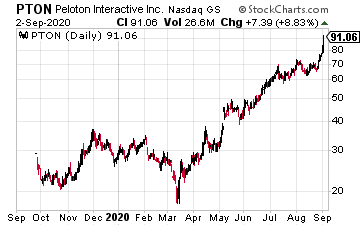

Peloton Interactive Inc. (PTON) just hit an all-time high of $83.67 – and is still pushing higher on news of its new Health and Wellness Advisory Council.

According to the company, “We constantly hear from our Members that Peloton has not only profoundly impacted their physical, mental and emotional health, but has also helped them cope with issues ranging from neurodegenerative disease or cancer, to PTSD or post-partum depression,” said William Lynch, president, Peloton. “With the addition of this esteemed Health and Wellness Advisory Council, which includes some of the best minds in medicine, we can leverage scientific research and medical expertise to help us better serve our community through our content, products and platform.”

At time of this writing, Ian Cooper does not hold a position in any of the stocks mentioned.