Dear Investor,

Share buybacks have become the rage for companies with large amounts of excess profits or free cash flow. Wall Street analysts love share buybacks as a way to “return capital to shareholders,” and many boards of directors give a lot of weight to what the analysts who follow their companies say.

My opinion is that in many cases, share buybacks turn into throwing away the money.

Let’s start with that “return capital to shareholders” misrepresentation. If a company buys back shares, whoever owned those shares and gets paid is no longer a shareholder, at least where tendered shares are concerned. So the company paid someone to stop them from being a shareholder.

When looking at it logically, a share buyback in no way returns capital to investors.

With a share buyback, the number of outstanding shares declines while the company’s earnings stay the same, automatically boosting the earnings per share (EPS).

The widely followed price-to-earnings ratio (P/E) divides the stock price by the EPS. Investors often use P/E to evaluate stocks. The expectation is that a share buyback will help push the share price higher.

However, there are two factors to consider.

First, a share buyback does not increase the company’s actual profits – it only increases the earnings per share. If the company does not make business decisions that will grow the bottom line, investors will see that and ignore the EPS gains from share buybacks.

More importantly, a share buyback does not ensure that the share price increases. I am sure you know that share prices often track the broader stock market. If the market takes a downturn, a share buyback will not keep the affected stock from following the rest of the market lower.

Bottom line: if, after a share buyback, the stock price goes down instead of up, all that money spent to buy in shares disappears. Poof, gone! Money thrown down the drain.

The other form of returning cash to shareholders, dividends, is the only valid form of letting investors participate in corporate profits. Paying an attractive and growing dividend indicates that a board of directors cares about individual investors like us. Declaring a share buyback shows the board is more interested in what Wall Street analysts think.

A share buyback is only a positive for investors if it is linked to an increase in the dividend rate. Remember that buybacks increase earnings per share, and higher EPS allows the company to increase its dividend rate. A stock with a growing dividend will always appreciate over time. You may not see it in the short term, but a growing dividend is a sure path to positive total returns.

My advice is to avoid stocks where companies buy back shares but do not support and grow a common stock dividend. Those companies may be literally throwing the buyback money away. However, it may help with management bonuses.

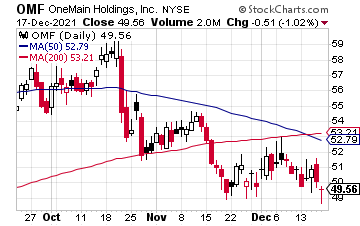

One company that recently increased its buyback authorization and will continue to grow dividends is OneMain Holdings Inc. (OMF). Earlier this year, OneMain increased its dividend by over 50%. The shares currently yield more than 5%. And that’s just one of the three dozen low-risk, high-yield stocks in my premium Dividend Hunter portfolio.

To learn more about it and see how you can get the full list and all my research, click here.