The electric vehicle story is accelerating as we head into 2022.

While EV stocks, like Tesla (TSLA) are still red-hot, another one to keep an eye on is XPeng Inc. (XPEV), a $38.6 billion EV company based in China.

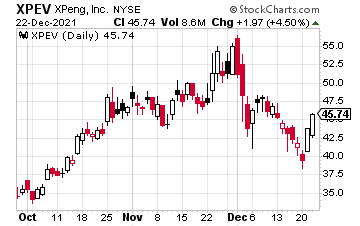

XPEV stock is technically oversold. However, after pulling back from about $55 to $39, the stock appears to have caught strong support, and is just starting to move up. In fact, as this is being written, RSI, MACD, and Williams’ %R are turning higher.

We’re just beginning to see bigger EV adoption around the world. For example, according to XPEV President and Vice Chairman, Brian Gu, noted by Yahoo Finance, the Chinese EV market has seen explosive growth. In the first 11 months of 2021, about three million EVs were sold in China—177.6% year-over-year growth. “This year we certainly saw an explosion of EV penetration. So let’s say a year ago, it’s a roughly 5% penetration. And as of late, [that] figure… is close to 19%. That’s a dramatic increase over the course of probably 15 to 18 months,” Gu explained.

XPEV is also seeing solid delivery numbers. In November, for example, the company delivered 5,613 vehicles—270% year-over-year growth. Cumulative deliveries jumped to 121,953 as of November, as well. Even better, as reported in a company press release:

- Total revenues were RMB 5,719.9 million (U.S. $887.7 million) for the third quarter of 2021, representing an increase of 187.4% from the same period of 2020, and an increase of 52.1% from the second quarter of 2021.

- Revenues from vehicle sales were RMB 5,460.1 million (U.S. $847.4 million) for the third quarter of 2021, representing an increase of 187.7% from the same period of 2020, and an increase of 52.3% from the second quarter of 2021.

- Gross margin was 14.4% for the third quarter of 2021, compared with 4.6% for the same period of 2020 and 11.9% for the second quarter of 2021.

With EV penetration showing no signs of slowing, XPEV could be one of the top stocks to own in New Year 2022. From a current price of $45.30, we’d like to see XPEV at $60, near-term.