When it comes to money, humans primarily react to the emotions of fear and greed. The effect of greed is to push investors to buy when prices are high, and fear triggers selling when investment prices are low.

For most stock market investors, the goal is to buy low and sell high, yet the emotions that drive their investment decisions often push them to do just the opposite. Most investors who try to “play” the markets end up buying high and selling low, which I am sure you understand is not a good way to build wealth.

I communicate regularly with my newsletter subscribers, and I see firsthand how hard it is to fight the emotions that try to drive our investment decisions. Every day I get questions about whether to buy stocks that are hitting new highs and trading at unsustainable valuations. History shows that buying when stock prices are high almost always leads to losses.

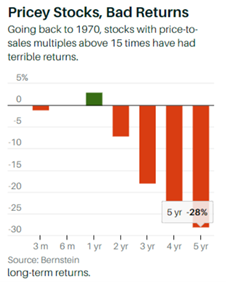

This chart shows the long-term returns from stocks purchased when they traded at high valuations. Using a 15 P/E for high may not be valid in this market, but I assure you: stocks trading at triple-digit multiples of earnings or even revenues are definitely overvalued.

On the flip side, I get “should I sell?” emails all the time when a stock has fallen, and the investor wants to know if she should sell. The fear is that, because the stock price is falling now, it will keep falling, possibly all the way to zero. It may not be logical, but that doesn’t alleviate the fears. The truth is selling after a stock has fallen locks in the losses perpetuating the “buy high and sell low” path to wealth erosion.

So what is the solution?

You need an investment strategy that takes emotions out of the decision process.

Almost always, long-term successful investment strategies base buy and sell decisions on the valuation of the stocks compared to the underlying business results. You want to buy when the stock value is low in relation to the business, and you want to have criteria that tell you when a stock has become overvalued, and it is time to sell. Your system should take the emotion out of your investment decisions of what and when to buy and sell.

With decades of stock market experience, I find that a dividend-focused investment strategy helps make the decisions discussed above easy to determine and implement. I evaluate a company to assess the ability to pay current dividends and grow them in the future. I then decide what would be an acceptable yield for that cash flow. For example, with a stable dividend, I like to see an 8% yield without many prospects for dividend growth. If the company should be able to grow the dividend every year, a 6% yield may be acceptable.

When I see yields much higher than these numbers, the stocks are undervalued, and I would add shares to boost my current portfolio yield. If a stock price rises, driving the yield down, I look at selling to lock in the gains and put the money to work in another, higher yield investment.

To summarize, a successful long-term investment strategy requires fundamental analysis, criteria for determining when a stock is over or undervalued, and the taking the emotion out of when to buy and sell.