Covered calls are one of the most popular investment strategies used by both retail and institutional traders. For retail traders, covered calls are easily accessible and don’t require a substantial amount of maintenance. For institutions, covered calls are beneficial both because they can scale into the billions of dollars and because they have long-term portfolio benefits.

There’s a reason why pension funds are active users of index covered calls, and there’s a reason why ETFs and mutual funds are specifically dedicated to covered call strategies. The fact of the matter is, covered calls work. They provide an edge.

So why is it that you’ll sometimes come across traders who will dismiss covered calls as a viable long-term strategy? Generally, it’s a trader using a sophisticated system, or someone who has an institutional background. These naysayers will lump all covered call strategies into one group and claim the entire bucket will underperform the market.

First off, there are numerous types of covered call strategies. For instance, comparing a basic buy/write strategy of selling at-the-money index calls to selling out-the-money calls on tech stocks is not an apples-to-apples comparison by any means.

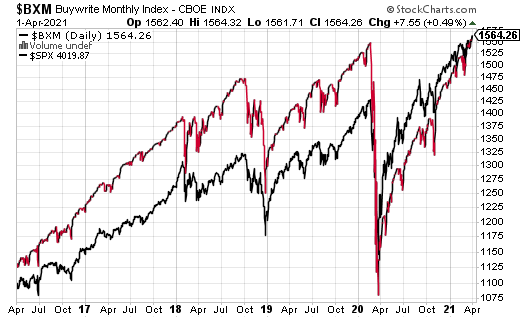

Nut here’s the thing: You’ll often see the BuyWrite Index (BXM) quoted by the anti-covered call crowd. BXM tracks a buy/write strategy using the S&P 500 and at-the-money calls that expire every 30 days. It’s the type of strategy that will outperform in sideways and down markets (as opposed to just buying the index) but will lag buy-and-hold in a bull market. Frankly, I don’t know anyone who trades covered calls this way. It’s simply a benchmark, nothing more.

Yet, as you can see in the chart, even the BXM is far from a terrible strategy. BXM had been outperforming the S&P 500 for five years until the March 2020 “coronacrash.” On the way back up (after the crash), the S&P 500 (buy-and-hold) outperformed BXM. However, it wasn’t until this steep upward move over the last year or so that buy-and-hold was clearly the better strategy.

Now, start to add in various factors to your covered call trading, and you can begin to find ways to outperform buy-and-hold. For example, using out-of-the-money calls will capture more upside in a bull market. Using a different index besides the S&P 500 can also make a big difference. Finally, and most obviously, you can use single stocks instead of indexes for buy/writes.

We’re not going to get into the different types of strategies in this article. However, I do want to ask the question: when did covered calls become so underrated?

First off, I think some (allegedly) sophisticated traders scoff at strategies that seem too simple to execute and maintain. These types of traders believe complexity leads to a trading edge; however, there’s no real evidence that this is the case.

Second, covered calls have become so ubiquitous that many traders feel their edge has disappeared. This may be true to some extent in the S&P 500 over a short timeframe, but, as I mentioned earlier, covered calls scale very well, and it’s difficult for it to be considered a crowded trade for that reason. Moreover, there are plenty of other liquid products besides the S&P 500 that can support covered call positions without considerably narrowing the edge.

It seems likely that the vast majority of traders who criticize covered calls have never run a covered call portfolio. After 20 years in this industry, the bottom line is I’ve never heard of a trader going bust because of covered calls.