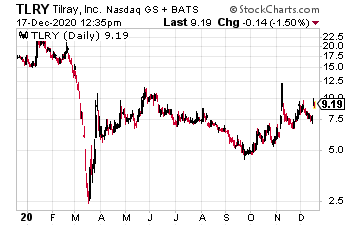

Tilray Inc. (TLRY) jumped 24% earlier this week on news it and Aphria are combining their businesses to become the world’s largest cannabis company. According TLRY’s latest press release, “On a pro forma basis for the last twelve months reported by each company, the Combined Company would have had revenue of C$874 million (US$685 million).”

According to Bloomberg, “The new company will keep Tilray’s name and trade under its ticker on the Nasdaq, and Aphria shareholders will own 62% of Tilray’s stock under the terms of the transaction, which was characterized as a “reverse acquisition of Tilray.”

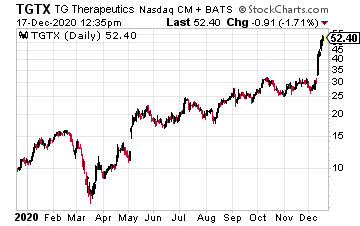

TG Therapeutics (TGTX) shares ran from a low of $27.50 to $48.90 in recent days. All after the company posted positive top line results from two Phase 3 studies for its Ublituximab treatment of multiple sclerosis patients. “Both studies met their primary endpoint of significantly reducing annualized relapse rate (ARR) with Ublituximab demonstrating an ARR of less than 0.10 in each of the studies,” the company said in a release.

However, the stock did pull back slightly the announced pricing of an underwritten public offering of 6,320,000 shares of common stock at a public offering price of $43.50 per share.

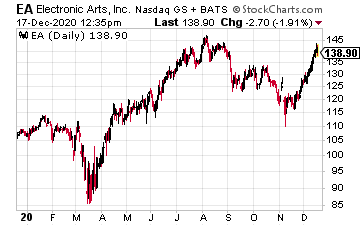

Electronic Arts Inc. (EA) jumped form a Nov. low of 117.50 to $142.48 in recent days. This follows news the company is buying UK gaming company, Codemasters for $1.2 billion.

“We believe there is a deeply compelling opportunity in bringing together Codemasters and Electronic Arts to create amazing and innovative new racing games for fans. Our industry is growing, the racing category is growing, and together we will be positioned to lead in a new era of racing entertainment. With the full leverage of EA’s technology, platform expertise, and global reach, this combination will allow us to grow our existing franchises and deliver more industry-defining racing experiences to a global fan base,” said Andrew Wilson, CEO of Electronic Arts.

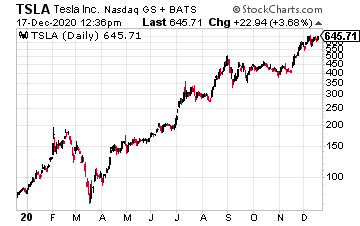

Tesla (TSLA) pulled back after Gordon Johnson, founder and CEO of GLJ Research said the stock’s valuation could come crashing down on two catalysts. The first one includes “Tesla’s upcoming addition to the S&P 500, set for Dec. 21, which Johnson says could see shareholders who were putting money into the stock ahead of the anticipated event, pulling back, and the loss of government-backed EV (electric vehicle) credits from rival automakers,” as noted on Yahoo Finance.

The other catalyst for downside could include TSLA being viewed as another over-hyped stock. “You’ve seen this before. I know it sounds crazy, look at Tilray, look at SunEdison, look at Suntech, some of these stocks, they went from $5 to $300 dollars, back to $5. They went from $2 to $300 back to zero,” Johnson added. “It does happen, and we think that Tesla is a prime candidate.”

At time of this writing, Ian Cooper does not hold a position in any of the stocks mentioned.