The 2020 second-quarter earnings season promises to be full of surprises – both positive and negative. Shareholders of stocks in index funds like SPY, DIA, and QQQ may be in for a rougher ride than they’d normally expect.

With a large portion of the U.S. economy, including companies in SPY, DIA, and QQQ, shut down for at least two-thirds of the quarter, it is impossible to predict what companies will report. However, there is one group of pass-through stocks that I predict will post surprisingly positive results for the 2020 second quarter.

A Business Development Company (BDC) operates under strict rules that define how the company will operate. Congress created the BDC structure to provide financing sources for small-to-mid-sized corporations. BDC customers are companies that are too small to tap the public debt and equity markets. For many of these companies, traditional bank loans are unavailable or too restrictive. BDCs offer the vital service of providing capital to America’s smaller corporations.

Buy and Hold These 3 Dividend Stocks Forever

What’s the one thing you need to stay retired? That’s right…cash. Money to pay the bills. Money to weather any financial crisis like the one we’re in now and whatever comes next. I’ve located three stocks that if you buy and hold them forever, they could serve as the backbone to your retirement. Click here for details.

The BDC rules provide them with pass-through status, which means they don’t pay corporate income tax if at least 90% of net income is paid as dividends to investors. There are also limits on how much debt a BDC can carry in relation to its equity. The result of the rules governing BDCs is that these are relatively high yield stocks with stable dividends.

The economic shutdown caused by the coronavirus pandemic has proven to be positive for BDCs. Individual business development companies found that their client companies suddenly needed additional capital to keep their businesses going. The BDCs were able to provide other support and guidance to help these clients survive the shutdown. I suspect that most BDCs will report surprisingly good second-quarter results.

When the BDCs reported 2020 first-quarter results, most took writedowns of their loan portfolios, reducing the book or net asset value (NAV) per share. NAV is an important metric that drives the stock market share prices. Quality BDCs will trade at a premium to NAV. The less well-run companies in the sector will be priced at a discount to NAV. The February-March stock market crash pushed the share prices of BDCs to trade at discounts to the reduced NAVs.

With the second-quarter earnings, I expect to see higher NAVs and sustained dividend payments. Those two factors will push up BDC share prices from the current discounts to close to NAV or even to moderate premiums. Here are three to watch.

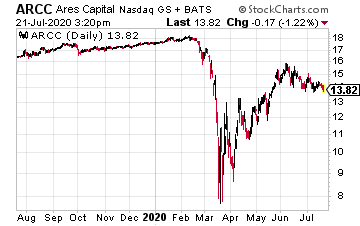

With a $6 billion market cap, Ares Capital (ARCC) is the largest BDC. In the first-quarter earnings, Ares Capital reported a NAV of $15.58 per share.

The NAV was down from $17.32 for the 2019 fourth quarter. Before the COVID crash, Ares Capital traded at a 10% premium to the fourth quarter NAV.

Now the share price is at a 9% discount to the lower first-quarter NAV. A NAV recovery plus share price recovery back to a premium means ARCC could go up 25% to 30%.

The ARCC dividend is stable, and the current yield is 11.25%.

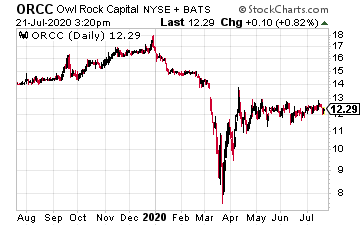

Owl Rock Capital Corp (ORCC) is a $5 billion market cap BDC that launched with a July 2019 IPO. With its first-quarter earnings, Owl Rock reported a NAV of $14.09, down from $15.24 in the previous quarter.

On July 13, Owl Rock reported June 30 NAV of $14.45 to $14.60. Owl Rock has declared dividends through the end of 2020.

The current share price is at a 14% discount to the latest NAV. Owl Rock should trade for at least a 10% premium.

The current yield is 9.8%.

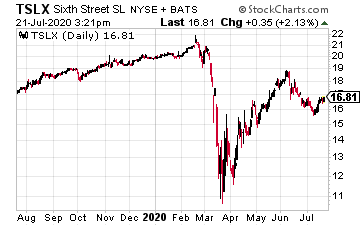

Sixth Street Specialty Lending, Inc. (TSLX), formerly called TPG Specialty Lending, changed names in June.

Like the other BDCs here, the Sixth Street NAV dropped to $15.07 for the first quarter, down from the previous $16.77. Sixth Street is the exception, with a current share price above the latest reported NAV.

The company has paid extra special dividends for the last few quarters. An improving NAV plus a special dividend announcement could drive Sixth Street 15% to 20% higher.

The current yield is 9.9%.