The stock market crash that began at the end of February and lasted through the end of March was especially brutal for high-yield investments. There is some logic to the deep sell-off of higher yield dividend stocks. These companies pay out most of their free cash flow as dividends, and the economic shutdown puts those cash flows at risk. However, the income stock sell-off was overdone, with little regard to which companies would be able to keep paying dividends, and which would be challenged to continue regular payouts to investors.

I was pleasantly surprised to find the business development company (BDC) business model was suited to thrive in the coronavirus-triggered financial crisis. The stock market sell-off has put BDC stocks essentially “on sale.” These are companies with solid business prospects, stable dividends, and well-above-historical yields.

A BDC invests in small-to-midsized corporations. These investments are usually business loans. However, some BDCs also make equity investments in their client companies. For many smaller businesses, using a BDC as a lending source is their primary choice. Many cannot get loans from commercial banks, and they are too small to tap into the public stock and bond markets. Business development companies fill an essential gap in the U.S. business finance picture.

The #1 Stock to Retire on (Over $1 million in income up for grabs)

Retiring well doesn’t have to be complicated. Forget “buy and hold” investments… forget options… forget Bitcoin…

One stock is all you need. And it’s not a blue chip stock like Wal-Mart. Over your entire retirement, you should see over $1 million hit your bank account thanks to this stock.

If you’re serious about a retirement with less financial worries, this #1 stock is your secret weapon. The first payout of the $1 million is days away.

.

The pandemic revealed how vital a relationship with a BDC could be for a small company. The business development companies provided capital when it was most needed. They also offered business advice to help client companies navigate the crisis. Main Street Capital (MAIN) CEO Dwayne Hyzak made this remark during the 2020 first-quarter earnings analyst call:

“We’ve also maintained a very consistent approach of aligning our interest directly with these individuals through our typical investment structure, and we believe this alignment is a significant strength and source of value for us and our shareholders.

Throughout the last few months, as our Main Street investment teams have been extremely active in working with our portfolio companies, the strength of these portfolio company management teams has never been more evident or remote more valuable to us. We are extremely appreciative of the diligent efforts and proactive actions taken by our portfolio companies…”

Strong business relationships with client companies have allowed BDCs to continue to pay regular dividends. Management teams from many BDCs stated they expect dividends to continue through the crisis and recovery.

Here are the three largest BDCs by market cap:

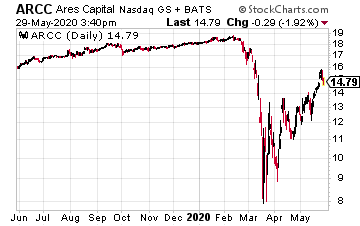

Ares Capital (ARCC) is the largest company in the sector, with a $6.5 billion market cap.

On May 5, the company announced both that it would keep its quarterly dividend at $0.40 per share and that it expects to maintain a stable dividend for the foreseeable future.

The next dividend is payable on June 30 for shareholders of record on June 15.

Ares Capital has paid a stable to slowly growing dividend since 2009.

The current yield is 10.5%.

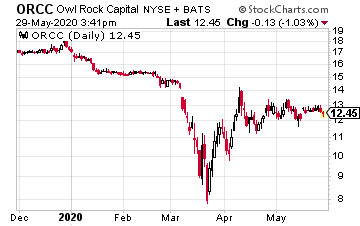

Owl Rock Capital Corp. (ORCC) is relatively new, having launched with a July 2019 IPO. Owl Rock’s market cap is $4.9 billion.

The BDC carries one of the more conservative balance sheets in the sector. By law, a BDC can leverage its equity with up to two times debt. The Owl Rock debt is just 0.60 times equity.

The majority of the investment portfolio consists of first-lien loans. Owl Rock’s dividend has been declared through the end of 2020.

The next dividend will be paid in mid-August.

ORCC currently yields 9.8%.

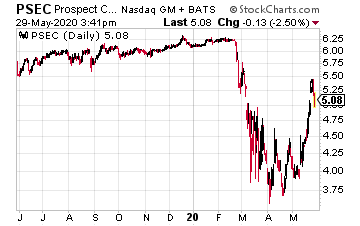

Prospect Capital Corp (PSEC) has a $2.0 billion market cap—company size falls off quickly once you get past the two largest BDCs.

Prospect Capital is one of the small number of BDCs paying monthly dividends, which is always a nice bonus.

The current $0.06 dividend has been paid since September 2017.

More importantly, the same rate will be paid through September 2020.

PSEC currently yields 13.4%.