Because I research and recommend high-yield investments, I often receive questions about individual closed-end funds, sometimes referred to as CEFs. According to CEF Connect, 285 closed-end funds yield between 5% and 28%. It is easy to understand why closed-end funds attract yield-hungry investors like moths to the flame.

When asked about a closed-end fund, my glib answer is that the closed-end fund universe is the junkyard of Wall Street. The risky closed-end fund products developed by Wall Street bankers—ones that their portfolio manager and retirement fund managers clients won’t touch—get shuffled off the closed-end funds.

Closed-end funds get the name because, after a fund’s IPO, the shares trade on the stock exchange, and the fund sponsors do not and will not redeem the shares. The sponsor manages the fund and collects attractive fees for doing so. The sponsor has no exposure to the risks (or lack of risks) of the fund.

As a result, when I dig into a closed-end funds investment strategy and portfolio holdings (I look at a lot of these funds), I almost always find that the fund’s 8%, or 10%, or 13% yield is not enough the pay for the risk investors take to own shares in the fund. In fact, throughout recommending high-yield investments to my Dividend Hunter subscribers, I have included just three closed-end funds on my recommendations list over the last seven years. (Here’s how to get access to the list.)

But as you know, with enough digging, you can find valuables even in a junkyard.

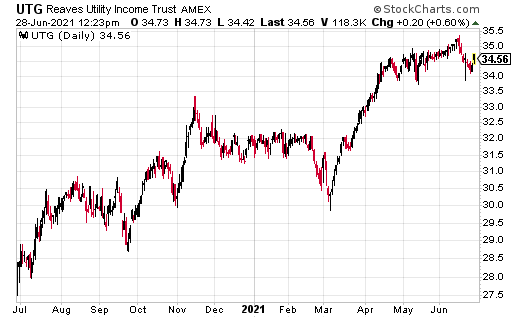

The Reaves Utility Income Fund (UTG) has been a Dividend Hunter investment since November 2015. The folks at Reaves Asset Management focus on utility and infrastructure companies. They have an excellent track record. Launched in February 2004, UTG has provided the steady returns you expect from a utilities-focused fund.

What attracted me for my Dividend Hunter service is that UTG pays a much higher yield than the average from utility stocks, and it pays monthly dividends. Outside of stock market dislocations, UTG has posted a steady 6% yield, and the Reaves folks have steadily grown the dividend. A decade ago, it was $0.125 per share per month. Last week, they again increased the payout by a penny to $0.19 per share.

The UTG dividends consist of portfolio income from dividends and realized capital gains. This closed-end fund has never paid out return-of-capital as dividends. The dividend has increased four times since I first recommended the fund.

Let’s close out with some return numbers. With the newly increased dividend, UTG yields 6.6%( the dividend grew by 5.6%). Since my November 2015 recommendation, the fund has returned 8.23% per year. That is through three market corrections and a bear market. If you put the dividends on auto reinvest, the annual return jumps up to 9.82%. There is power in compounding high-yield monthly dividends!

It turns out UTG was a gold nugget hiding in the closed-end fund junkyard.