Dear Investor,

Last week, the Federal Home Loan Mortgage Corporation (FHLMC), better known as Freddie Mac, reported that the average interest rate for 30-year fixed-rate mortgages jumped to 3.45%, up from slightly more than 3% a month ago, and 2.79% one year ago.

Higher rates hurt traditional mortgage companies – refinancing business dries up, and house payments move higher for potential home buyers, making them less likely to buy.

However, one type of mortgage asset benefits from higher mortgage rates – and I have a stock in mind in this category that’s set to do very well in the coming years…

One of the most profitable parts of the residential mortgage industry are mortgage servicing rights (MSRs). These are payments made to the companies that service home loans.

For your mortgage, the servicer is the company to which you send your mortgage payment.

Now, the MSRs will be 0.25% (25 basis points) per year on residential mortgages. But the actual expenses to service a mortgage run at just half that, about 10 to 12 basis points.

As a result, the excess MSRs are a source of tremendous free cash flow.

A pool of MSRs is a depleting asset. The unpaid balance runs off as homeowners make their mortgage payments and loans in the pool get paid off or refinanced.

Low mortgage rates lead to increased refinancing levels and a more rapid decline in the MSR income stream. In periods of low rates, the value of an MSR portfolio declines.

On the flip side, higher mortgage rates cause MSRs to become more valuable. The revenue stream from an MSR pool stretches out, paying more money to the MSR holder for longer.

So today’s rising mortgage rates are great news for the company I want to tell you about today.

Throughout its eight years as a public company, New Residential Investment Corp (NRZ) operated primarily as a mortgage securities investment company emphasizing investing in MSRs. Since the start of the pandemic, New Residential has aggressively moved to become a full-service residential mortgage company.

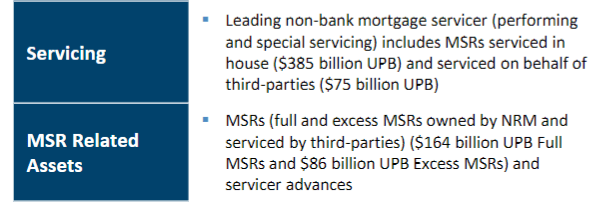

However, MSRs remain a focus and a large portion of the company’s investment portfolio. This graphic comes from New Residentials 2021 third-quarter earnings presentation:

A little math shows that New Residential has its finger in an MSR pie with more than $600 billion of unpaid mortgage balances. Another chart in the presentation shows that NRZ earns excess MSRs on $635 billion of outstanding mortgage balances.

With mortgage rates moving quickly higher, the value of these MSR holdings will explode. For the 2021 third quarter, the company reported a book value of $11.35 per share, and by the time we see the 2022 first-quarter results, that number could be in the mid-teens.

New Residential’s current $0.25 per share dividend gives the stock a 9% yield. I expect the quarterly rate to be $0.35 to $0.40 by the end of the year. Putting a 9% yield on a $1.40 dividend gives a $15.50 share price. If the Fed increases interest rates four times this year, as anticipated, these dividend boosts and share price gains for NRZ are almost a lock.

And the entry point is low, as NRZ currently trades for around $11.00.

If you like that, I have a whole portfolio of three dozen income stocks all set to pay even more dividends as interest rates go up.

Combine that with my 36-month plan that uses these stocks to set you up for a potential $4,804 in monthly income…

And there’s no better way to prepare your portfolio for higher interest rates.